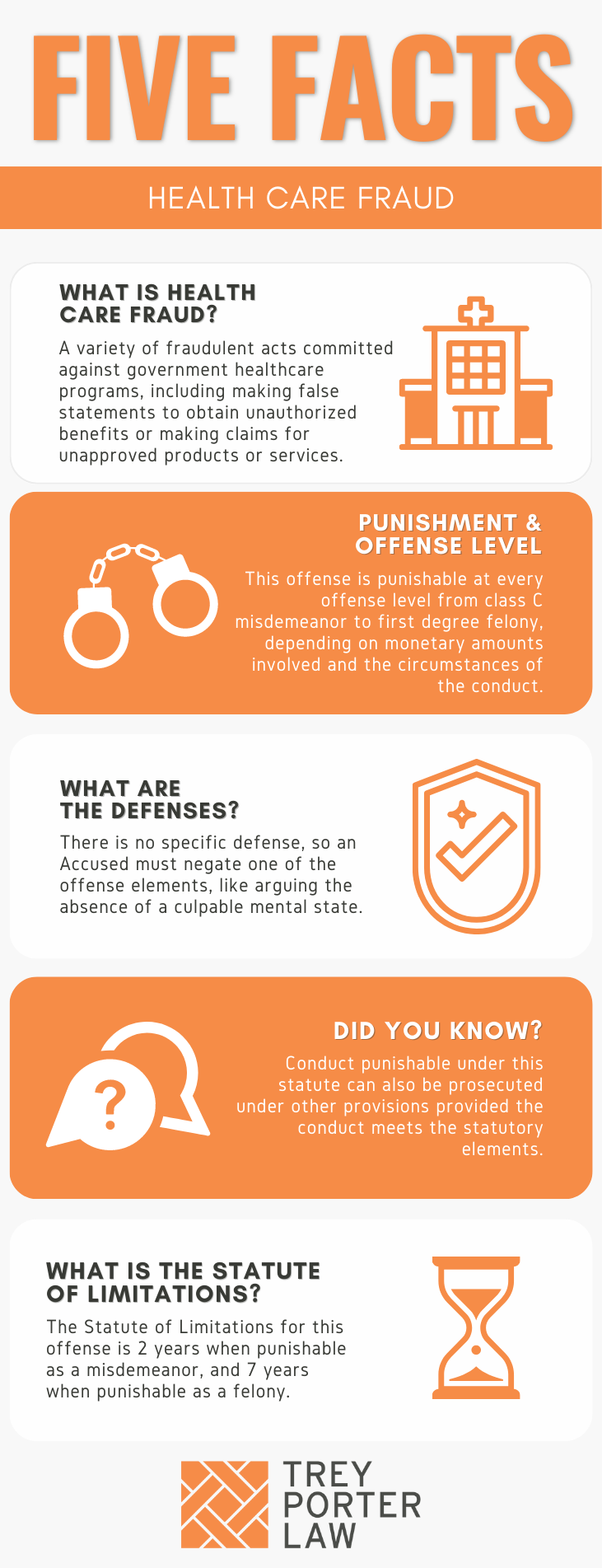

WHAT IS HEALTH CARE FRAUD IN TEXAS?

The Texas law against health care fraud prohibits fraudulent conduct committed against governmental health care programs. The statute contains 12 different ways in which the offense is committed. A person commits health care fraud by knowingly:

- making a false statement or misrepresentation of material fact to get an unauthorized health care program benefit or payment;

- concealing or failing to disclose information in order to get an unauthorized health care program benefit or payment;

- applying for and receiving a health care program benefit or payment on behalf of another, and using the benefit or payment for an unauthorized purpose;

- making, inducing, or seeking to induce another to make a false statement or misrepresentation regarding:

- a facility’s conditions or operation in order to be certified under a health care program; or

- information pertaining to a health care program required to be provided by law;

- paying, charging, soliciting, accepting, or receiving a gift, donation, money, or other consideration for a health care service or product, when it has already been paid for by the health care program;

- presenting a claim for payment under a health care program for a product or service provided by an unlicensed person;

- making a claim for an unapproved, inadequate, or inappropriate service or product, or for a mislabeled, adulterated, or debased product;

- failing to indicate in a claim the type of license and identification number of the health care practitioner who provided the service;

- entering into an agreement, combination, or conspiracy to defraud the state or federal government by obtaining or aiding another in obtaining an unauthorized health care benefit or payment;

- as a managed care organization who contracts with a state or federal government agency to provide or arrange health care benefits or services to eligible individuals:

- failing to provide the required benefits or services to an individual;

- failing to provide or falsifying information required to be provided; or

- engaging in fraudulent activity in enrolling eligible individuals or marketing to the organization’s services to eligible individuals;

- obstructing an investigation by the attorney general of unlawful acts under the Texas Human Resources Code; or

- making or using a false record or statement to conceal, avoid, or decrease an obligation under a health care program to pay or transmit money or property to the state or federal government.

WHAT IS THE HEALTH CARE FRAUD LAW IN TEXAS?

Tex. Penal Code § 35A.02. HEALTH CARE FRAUD.

(a) A person commits an offense if the person:

(1) knowingly makes or causes to be made a false statement or misrepresentation of a material fact to permit a person to receive a benefit or payment under a health care program that is not authorized or that is greater than the benefit or payment that is authorized;

(2) knowingly conceals or fails to disclose information that permits a person to receive a benefit or payment under a health care program that is not authorized or that is greater than the benefit or payment that is authorized;

(3) knowingly applies for and receives a benefit or payment on behalf of another person under a health care program and converts any part of the benefit or payment to a use other than for the benefit of the person on whose behalf it was received;

(4) knowingly makes, causes to be made, induces, or seeks to induce the making of a false statement or misrepresentation of material fact concerning:

(A) the conditions or operation of a facility in order that the facility may qualify for certification or recertification under a health care program; or

(B) information required to be provided by a federal or state law, rule, regulation, or provider agreement pertaining to a health care program;

(5) except as authorized under a health care program, knowingly pays, charges, solicits, accepts, or receives, in addition to an amount paid under the health care program, a gift, money, donation, or other consideration as a condition to the provision of a service or product or the continued provision of a service or product if the cost of the service or product is paid for, in whole or in part, under a health care program;

(6) knowingly presents or causes to be presented a claim for payment under a health care program for a product provided or a service rendered by a person who:

(A) is not licensed to provide the product or render the service, if a license is required; or

(B) is not licensed in the manner claimed;

(7) knowingly makes or causes to be made a claim under a health care program for:

(A) a service or product that has not been approved or acquiesced in by a treating physician or health care practitioner;

(B) a service or product that is substantially inadequate or inappropriate when compared to generally recognized standards within the particular discipline or within the health care industry; or

(C) a product that has been adulterated, debased, mislabeled, or that is otherwise inappropriate;

(8) makes a claim under a health care program and knowingly fails to indicate the type of license and the identification number of the licensed health care practitioner who actually provided the service;

(9) knowingly enters into an agreement, combination, or conspiracy to defraud the state or federal government by obtaining or aiding another person in obtaining an unauthorized payment or benefit from a health care program or fiscal agent;

(10) is a managed care organization that contracts with the Health and Human Services Commission, another state agency, or the federal government to provide or arrange to provide health care benefits or services to individuals eligible under a health care program and knowingly:

(A) fails to provide to an individual a health care benefit or service that the organization is required to provide under the contract;

(B) fails to provide or falsifies information required to be provided by law, rule, or contractual provision; or

(C) engages in a fraudulent activity in connection with the enrollment of an individual eligible under a health care program in the organization’s managed care plan or in connection with marketing the organization’s services to an individual eligible under a health care program;

(11) knowingly obstructs an investigation by the attorney general of an alleged unlawful act under this section or under Section 32.039, 32.0391, or 36.002, Human Resources Code; or

(12) knowingly makes, uses, or causes the making or use of a false record or statement to conceal, avoid, or decrease an obligation to pay or transmit money or property to this state or the federal government under a health care program.

(b) An offense under this section is:

(1) a Class C misdemeanor if the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is less than $100;

(2) a Class B misdemeanor if the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is $100 or more but less than $750;

(3) a Class A misdemeanor if the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is $750 or more but less than $2,500;

(4) a state jail felony if:

(A) the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is $2,500 or more but less than $30,000;

(B) the offense is committed under Subsection (a)(11); or

(C) it is shown on the trial of the offense that the amount of the payment or value of the benefit described by this subsection cannot be reasonably ascertained;

(5) a felony of the third degree if:

(A) the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is $30,000 or more but less than $150,000; or

(B) it is shown on the trial of the offense that the defendant submitted more than 25 but fewer than 50 fraudulent claims under a health care program and the submission of each claim constitutes conduct prohibited by Subsection (a);

(6) a felony of the second degree if:

(A) the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is $150,000 or more but less than $300,000; or

(B) it is shown on the trial of the offense that the defendant submitted 50 or more fraudulent claims under a health care program and the submission of each claim constitutes conduct prohibited by Subsection (a); or

(7) a felony of the first degree if the amount of any payment or the value of any monetary or in-kind benefit provided or claim for payment made under a health care program, directly or indirectly, as a result of the conduct is $300,000 or more.

(c) If conduct constituting an offense under this section also constitutes an offense under another section of this code or another provision of law, the actor may be prosecuted under either this section or the other section or provision or both this section and the other section or provision.

(d) When multiple payments or monetary or in-kind benefits are provided under one or more health care programs as a result of one scheme or continuing course of conduct, the conduct may be considered as one offense and the amounts of the payments or monetary or in-kind benefits aggregated in determining the grade of the offense.

(e) The punishment prescribed for an offense under this section, other than the punishment prescribed by Subsection (b)(7), is increased to the punishment prescribed for the next highest category of offense if it is shown beyond a reasonable doubt on the trial of the offense that the actor was a high managerial agent at the time of the offense.

(f) With the consent of the appropriate local county or district attorney, the attorney general has concurrent jurisdiction with that consenting local prosecutor to prosecute an offense under this section that involves a health care program.

WHAT IS THE PENALTY CLASS FOR HEALTH CARE FRAUD IN TEXAS?

The penalty classification for health care fraud depends on the value of the monetary or in-kind benefit provided or claim for payment made under a health care program, whether a direct or indirect result of the conduct:

- Class C misdemeanor, punishable by a maximum $500 fine, if:

- the value of the payment or benefit is less than $100;

- Class B misdemeanor, punishable by up to 180 days in county jail, if:

- the value of the payment or benefit is $100 or more but less than $750;

- Class A misdemeanor, punishable by up to one year in county jail, if:

- the value of the payment or benefit is $750 or more but less than $2,500;

- State jail felony, punishable by 180 days to two years in a state jail facility, if:

- the value of the payment or benefit is $2,500 or more but less than $30,000;

- the value of the payment or benefit cannot be reasonably ascertained; or

- the offense is committed by knowingly obstructing an investigation by the attorney general of health care fraud under the Penal Code or Texas Human Resources Code;

- Third degree felony, punishable by two to ten years in prison, if:

- the value of the payment or benefit is $30,000 or more but less than $150,000; or

- the accused submitted 25 or more but less than 50 fraudulent claims;

- Second degree felony, punishable by two to 20 years in prison, if:

- the value of the payment or benefit is $150,000 or more but less than $300,000; or

- the accused submitted 50 or more fraudulent claims;

- First degree felony, punishable by five to 99 years in prison, if:

- the value of the payment or benefit is $300,000 or more.

WHAT IS THE PUNISHMENT RANGE FOR HEALTH CARE FRAUD IN TEXAS?

The punishment range for health care fraud corresponds to the amount of claims submitted, and the value of the claim, payment, or benefit.

- First degree felony (value of $300,000 or more):

- five to 99 years or life in prison, maximum $10,000 fine;

- Second degree felony (value of $150,000 or more but less than $300,000):

- two to 20 years in prison, maximum $10,000 fine;

- Third degree felony (value of $30,000 or more but less than $150,000):

- two to ten years in prison, maximum $10,000 fine;

- State jail felony (value of $2,500 or more but less than $30,000):

- 180 days to two years in a state jail facility, maximum $10,000 fine;

- Class A misdemeanor (value of $750 or more but less than $2,500):

- up to one year in jail, maximum $4,000 fine;

- Class B misdemeanor (value of $100 or more but less than $750):

- up to 180 days in jail, maximum $2,000 fine;

- Class C misdemeanor (value of less than $100):

- maximum $500 fine.

WHAT ARE THE PENALTIES FOR HEALTH CARE FRAUD IN TEXAS?

A person charged with health care fraud may be eligible for probation after a conviction, or deferred adjudication without a conviction. The period of community supervision for a Class A or Class B misdemeanor may not exceed two years. A person may be placed on deferred adjudication for a Class C misdemeanor for up to 180 days.

Community supervision for health care fraud charged as a state jail felony may range from two to five years, with the possibility of extending supervision for up to ten years.

A person charged with third degree felony health care fraud may be placed on probation for a term between two and five years, or deferred adjudication for up to ten years. If charged with a second degree felony or first degree felony, the period of community supervision may not exceed ten years.

- Will a health care fraud conviction affect a doctor’s or nurse’s employment in Texas? Yes, it can. Texas Health and Safety Code Section 250.006 prohibits most health care facilities from hiring anyone with criminal convictions for various offenses, including health care fraud.

WHAT ARE THE DEFENSES TO HEALTH CARE FRAUD IN TEXAS?

The statute does not authorize specific defenses to health care fraud. A person accused thereof may attempt to negate at least one of the elements the State must prove at trial.

- Can a person be charged with health care fraud in Texas for accidentally making a false claim? No, if the submission or false statement was in fact made by mistake. The health care fraud statute requires proof that the person knowingly committed the illegal conduct.

- What is Medicaid in Texas? The Texas Human Resources Code Section 32.003 explains Medicaid is medical assistance, including all of the health care and related services and benefits authorized or provided under federal law for needy individuals in Texas.

WHAT IS THE STATUTE OF LIMITATIONS FOR HEALTH CARE FRAUD IN TEXAS?

The limitation period for health care fraud categorized as a felony is seven years. If the health care fraud is a misdemeanor, the limitation period is two years.

HEALTH CARE FRAUD IN TEXAS

Health care fraud in Texas punishes all types of conduct in which a person or organization knowingly lies to the government or withholds information in order to get money or other benefits to which the person would not ordinarily be entitled under a health care program.