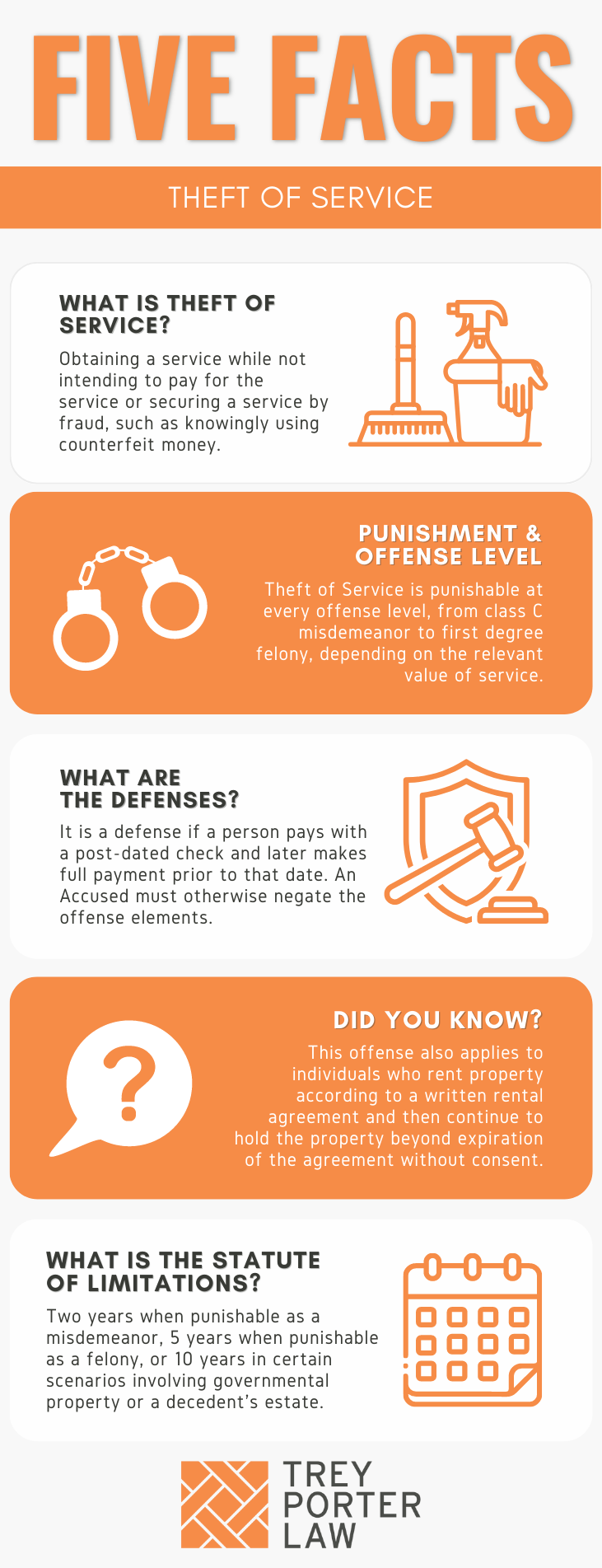

WHAT IS THEFT OF SERVICE IN TEXAS?

The Texas law against theft of service prohibits inducing another to provide services without intending to pay for them.

WHAT IS THE THEFT OF SERVICE LAW IN TEXAS?

Tex. Penal Code § 31.04. THEFT OF SERVICE.

(a) A person commits theft of service if, with intent to avoid payment for service that the actor knows is provided only for compensation:

(1) the actor intentionally or knowingly secures performance of the service by deception, threat, or false token;

(2) having control over the disposition of services of another to which the actor is not entitled, the actor intentionally or knowingly diverts the other’s services to the actor’s own benefit or to the benefit of another not entitled to the services;

(3) having control of personal property under a written rental agreement, the actor holds the property beyond the expiration of the rental period without the effective consent of the owner of the property, thereby depriving the owner of the property of its use in further rentals; or

(4) the actor intentionally or knowingly secures the performance of the service by agreeing to provide compensation and, after the service is rendered, fails to make full payment after receiving notice demanding payment.

(b) For purposes of this section, intent to avoid payment is presumed if any of the following occurs:

(1) the actor absconded without paying for the service or expressly refused to pay for the service in circumstances where payment is ordinarily made immediately upon rendering of the service, as in hotels, campgrounds, recreational vehicle parks, restaurants, and comparable establishments;

(2) the actor failed to make payment under a service agreement within 10 days after receiving notice demanding payment;

(3) the actor returns property held under a rental agreement after the expiration of the rental agreement and fails to pay the applicable rental charge for the property within 10 days after the date on which the actor received notice demanding payment;

(4) the actor failed to return the property held under a rental agreement:

(A) within five days after receiving notice demanding return, if the property is valued at less than $2,500;

(B) within three days after receiving notice demanding return, if the property is valued at $2,500 or more but less than $10,000; or

(C) within two days after receiving notice demanding return, if the property is valued at $10,000 or more; or

(5) the actor:

(A) failed to return the property held under an agreement described by Subsections (d-2)(1)-(3) within five business days after receiving notice demanding return; and

(B) has made fewer than three complete payments under the agreement.

(c) For purposes of Subsections (a)(4), (b)(2), (b)(4), and (b)(5), notice must be:

(1) in writing;

(2) sent by:

(A) registered or certified mail with return receipt requested; or

(B) commercial delivery service; and

(3) sent to the actor using the actor’s mailing address shown on the rental agreement or service agreement.

(d) Except as otherwise provided by this subsection, if written notice is given in accordance with Subsection (c), it is presumed that the notice was received not later than two days after the notice was sent. For purposes of Subsections (b)(4)(A) and (B) and (b)(5), if written notice is given in accordance with Subsection (c), it is presumed that the notice was received not later than five days after the notice was sent.

(d-1) For purposes of Subsection (a)(2), the diversion of services to the benefit of a person who is not entitled to those services includes the disposition of personal property by an actor having control of the property under an agreement described by Subsections (d-2)(1)-(3), if the actor disposes of the property in violation of the terms of the agreement and to the benefit of any person who is not entitled to the property.

(d-2) For purposes of Subsection (a)(3), the term “written rental agreement” does not include an agreement that:

(1) permits an individual to use personal property for personal, family, or household purposes for an initial rental period;

(2) is automatically renewable with each payment after the initial rental period; and

(3) permits the individual to become the owner of the property.

(d-3) For purposes of Subsection (a)(4):

(1) if the compensation is or was to be paid on a periodic basis, the intent to avoid payment for a service may be formed at any time during or before a pay period;

(2) the partial payment of wages alone is not sufficient evidence to negate the actor’s intent to avoid payment for a service; and

(3) the term “service” does not include leasing personal property under an agreement described by Subsections (d-2)(1)-(3).

(d-4) A presumption established under Subsection (b) involving a defendant’s failure to return property held under an agreement described by Subsections (d-2)(1)-(3) may be refuted if the defendant shows that the defendant:

(1) intended to return the property; and

(2) was unable to return the property.

(d-5) For purposes of Subsection (b)(5), “business day” means a day other than Sunday or a state or federal holiday.

(e) An offense under this section is:

(1) a Class C misdemeanor if the value of the service stolen is less than $100;

(2) a Class B misdemeanor if the value of the service stolen is $100 or more but less than $750;

(3) a Class A misdemeanor if the value of the service stolen is $750 or more but less than $2,500;

(4) a state jail felony if the value of the service stolen is $2,500 or more but less than $30,000;

(5) a felony of the third degree if the value of the service stolen is $30,000 or more but less than $150,000;

(6) a felony of the second degree if the value of the service stolen is $150,000 or more but less than $300,000; or

(7) a felony of the first degree if the value of the service stolen is $300,000 or more.

(f) Notwithstanding any other provision of this code, any police or other report of stolen vehicles by a political subdivision of this state shall include on the report any rental vehicles whose renters have been shown to such reporting agency to be in violation of Subsection (b)(2) and shall indicate that the renting agency has complied with the notice requirements demanding return as provided in this section.

(g) It is a defense to prosecution under this section that:

(1) the defendant secured the performance of the service by giving a post-dated check or similar sight order to the person performing the service; and

(2) the person performing the service or any other person presented the check or sight order for payment before the date on the check or sight order.

Tex. Penal Code § 31.08. VALUE.

(a) Subject to the additional criteria of Subsections (b) and (c), value under this chapter is:

(1) the fair market value of the property or service at the time and place of the offense; or

(2) if the fair market value of the property cannot be ascertained, the cost of replacing the property within a reasonable time after the theft.

(b) The value of documents, other than those having a readily ascertainable market value, is:

(1) the amount due and collectible at maturity less that part which has been satisfied, if the document constitutes evidence of a debt; or

(2) the greatest amount of economic loss that the owner might reasonably suffer by virtue of loss of the document, if the document is other than evidence of a debt.

(c) If property or service has value that cannot be reasonably ascertained by the criteria set forth in Subsections (a) and (b), the property or service is deemed to have a value of $750 or more but less than $2,500.

(d) If the actor proves by a preponderance of the evidence that he gave consideration for or had a legal interest in the property or service stolen, the amount of the consideration or the value of the interest so proven shall be deducted from the value of the property or service ascertained under Subsection (a), (b), or (c) to determine value for purposes of this chapter.

WHAT IS THE PENALTY CLASS FOR THEFT OF SERVICE IN TEXAS?

The penalty class for theft of service depends on the value of the service stolen.

- Class C misdemeanor, punishable by a maximum $500 fine, if:

- the value is less than $100;

- Class B misdemeanor, punishable by up to 180 days in county jail, if:

- the value of the service stolen is $100 or more but less than $750;

- Class A misdemeanor, punishable by up to one year in county jail, if:

- the value of the service stolen is $750 or more but less than $2,500;

- State jail felony, punishable by 180 days to two years in a state jail facility, if:

- the value of the service stolen is $2,500 or more but less than $30,000; or

- Third degree felony, punishable by two to ten years in prison, if:

- the value of the service stolen is $30,000 or more but less than $150,000;

- Second degree felony, punishable by two to 20 years in prison, if:

- the value of the service stolen is $150,000 or more but less than $300,000;

- First degree felony, punishable by five to 99 years or life in prison, if:

- the value of the service stolen is over $300,000.

WHAT IS THE PUNISHMENT RANGE FOR THEFT OF SERVICE IN TEXAS?

The punishment range for theft of service increases with the value of the stolen service.

- Class C misdemeanor, if the value of the service stolen is less than $100:

- maximum fine of $500, no jail time;

- Class B misdemeanor, if the value of the service stolen is $100 or more but less than $750:

- up to 180 days in jail, maximum fine of $2,000;

- Class A misdemeanor, if the value of the service stolen is $750 or more but less than $2,500:

- up to one year in jail, maximum fine of $4,000;

- State jail felony, if the value of the service stolen is $2,500 or more but less than $30,000:

- 180 days to two years in a state jail facility, maximum fine of $10,000;

- Third degree felony, if the value of the service stolen is $30,000 or more but less than $150,000:

- two to ten years in prison, maximum fine of $10,000;

- Second degree felony, if the value of the service stolen is $150,000 or more but less than $300,000:

- two to 20 years in prison, maximum fine of $10,000;

- First degree felony, if the value of the service stolen is $300,000 or more:

- five to 99 years or life in prison, maximum fine of $10,000.

WHAT ARE THE PENALTIES FOR THEFT OF SERVICE IN TEXAS?

A person charged with theft of service may be eligible for probation after a conviction, or deferred adjudication without a conviction. The period of community supervision depends on the offense category.

There is no community supervision required after a Class C misdemeanor conviction, but a person charged with a Class C misdemeanor theft of service may be placed on deferred adjudication for up to 180 days.

The period of community supervision for Class A or Class B misdemeanors may not exceed two years. Pursuant to Texas Code of Criminal Procedure article 42A.302, a judge may order up to 30 days in jail as a condition of misdemeanor community supervision.

The period of community supervision for a state jail felony theft of service is from two to five years, with the possibility of extending supervision for up to ten years.

For a third degree felony theft of service charge, a person may be placed on deferred adjudication for up to ten years, or probation for a period between two and five years.

The period of community supervision for first degree felony and second degree felony theft of service charges may not exceed ten years. Pursuant to Texas Code of Criminal Procedure article 42A.302, a judge may order up to 180 days in jail as a condition of felony community supervision.

WHAT ARE THE DEFENSES TO THEFT OF SERVICE IN TEXAS?

The theft of service statute authorizes a specific defense to theft of service by writing a check or similar sight order: if the accused paid for a service with a post-dated check or similar sight order, and the recipient presents the check or sight order prior to the date thereon, the accused may raise this defense at trial.

Otherwise, a person accused of theft of service may attempt to negate at least one of the elements the State must prove. For example, that he or she formed the intent not to pay for the service after it was rendered, not before, which negates the element that the performance was secured by deception, threat, or false token.

- What is theft of service by deception? In Texas, unlawfully appropriating property is without the owner’s consent if the owner was deceived. Texas Penal Code Section 31.01 defines “deception” as:

- creating or confirming a false impression;

- failing to correct a false impression;

- preventing another from acquiring information;

- selling or otherwise transferring or encumbering property without disclosing a lien, security interest, adverse claim, or other legal impediment; or

- promising a performance with no intent to perform or that will not be performed.

The deceptive act must have secured the performance of services—i.e., the deception must have preceded the service.

In Daugherty v. State, the defendant signed a construction-service contract with a general contractor to build out office space for her window-tinting company. She wrote the contractor a $1,657 check as a deposit, with the remaining $48,000 due upon completion. When the contractor finished the build-out, the defendant gave him an insufficient-funds check for the rest, and was convicted of theft of service by deception.

The Court of Criminal Appeals reversed the conviction. There was no evidence the defendant secured the contractor’s service by an act of deception. Rather, the deceptive act—writing the bad check—occurred after the service, and there was no evidence the defendant intended to deceive the contractor at the inception.

WHAT IS THE STATUTE OF LIMITATIONS FOR THEFT OF SERVICE IN TEXAS?

The limitation period for felony theft of service is five years under most circumstances, and the limitations period for misdemeanor theft of service is two years.

The limitation period is ten years for:

- theft of government property by a public servant who had control over the property in his or her official capacity; or

- theft of any part of an estate by an executor, administrator, guardian, or trustee with intent to defraud any creditor, heir, legatee, ward, distributee, beneficiary, or settlor of a trust interested in the estate.

THEFT OF SERVICE IN TEXAS

The Texas law against theft of service prohibits inducing another to provide services without compensating the service provider.

TEXAS THEFT OF SERVICE COURT CASES

The case law regarding theft of service in Texas illustrates the statute’s application.

- In Norman v. State, the defendant called an auto repair shop to tow and fix his car. The shop owner quoted him an estimate of roughly $3,900. After the repairs were done, he wrote the shop owner a check for the total cost of $3,971.33. When the owner attempted to deposit the check, it was returned for insufficient funds.The defendant was convicted of theft of service, and the appellate court affirmed. The defendant’s account balance was $33.77 at the time he authorized the repairs, and $4.47 when he wrote the check. The evidence supported the inference that the defendant never intended to pay for the repairs at the time he authorized them.