WHAT IS MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS?

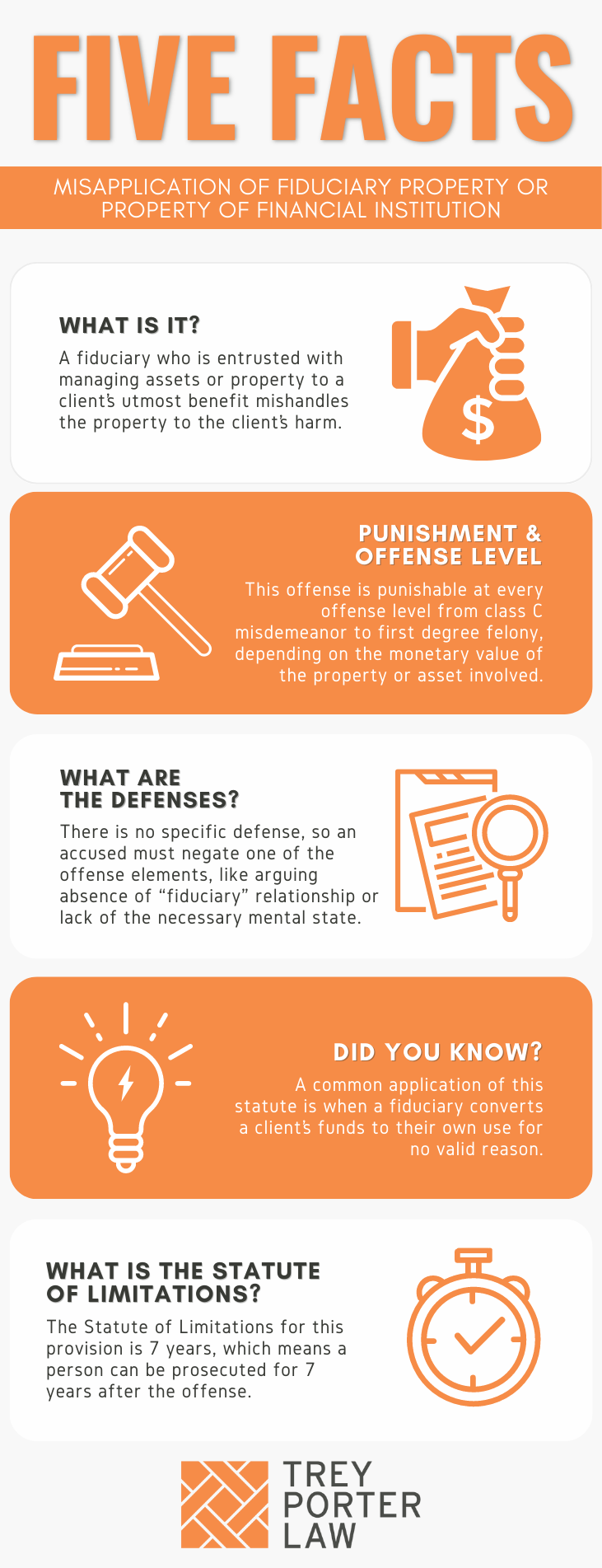

The Texas law against misapplication of fiduciary property or property of a financial institution prohibits a person who is acting as a fiduciary holding property for another from mishandling the property against the other’s interest.

WHAT IS THE MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION LAW IN TEXAS?

Tex. Penal Code § 32.45. MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION.

(b) A person commits an offense if he intentionally, knowingly, or recklessly misapplies property he holds as a fiduciary or property of a financial institution in a manner that involves substantial risk of loss to the owner of the property or to a person for whose benefit the property is held.

(c) An offense under this section is:

(1) a Class C misdemeanor if the value of the property misapplied is less than $100;

(2) a Class B misdemeanor if the value of the property misapplied is $100 or more but less than $750;

(3) a Class A misdemeanor if the value of the property misapplied is $750 or more but less than $2,500;

(4) a state jail felony if the value of the property misapplied is $2,500 or more but less than $30,000;

(5) a felony of the third degree if the value of the property misapplied is $30,000 or more but less than $150,000;

(6) a felony of the second degree if the value of the property misapplied is $150,000 or more but less than $300,000; or

(7) a felony of the first degree if the value of the property misapplied is $300,000 or more.

(d) An offense described for purposes of punishment by Subsections (c)(1)-(6) is increased to the next higher category of offense if it is shown on the trial of the offense that the offense was committed against an elderly individual.

(e) With the consent of the appropriate local county or district attorney, the attorney general has concurrent jurisdiction with that consenting local prosecutor to prosecute an offense under this section that involves the state Medicaid program.

WHAT IS THE PENALTY CLASS FOR MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS?

The penalty category for misapplication of fiduciary property or property of a financial institution depends on the value of the property misapplied. If the value of the property misapplied is:

- Less than $100:

- Class C misdemeanor, punishable by up to a $500 fine, and no jail time;

- $100 to $749:

- Class B misdemeanor, punishable by up to 180 days in county jail;

- $750 to $2499:

- Class A misdemeanor, punishable by up to one year in county jail;

- $2500 to $29,999:

- State jail felony, punishable by 180 days to two years in a state jail facility;

- $30,000 to $149,000:

- Third degree felony, punishable by two to ten years in prison;

- $150,000 to $299,999:

- Second degree felony, punishable by two to 20 years in prison;

- $300,000 or more:

- First degree felony, punishable by five to 99 years or life in prison.

If a fiduciary misapplies an elderly person’s property, the offense is increased to the next highest category. If the value of the property misapplied exceeds $300,000, the offense remains a first degree felony.

WHAT IS THE PUNISHMENT RANGE FOR MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS?

The punishment range for misapplication of fiduciary property or property of a financial institution increases with the value of property misapplied:

- Class C misdemeanor, if the value is less than $100:

- maximum fine of $500, no jail time;

- Class B misdemeanor, if the value is $100 or more but less than $750:

- up to 180 days in jail, maximum fine of $2,000;

- Class A misdemeanor, if the value is $750 or more but less than $2,500:

- up to one year in jail, maximum fine of $4,000;

- State jail felony, if the value is $2,500 or more but less than $30,000:

- 180 days to two years in a state jail facility, maximum fine of $10,000;

- Third degree felony, if the value is $30,000 or more but less than $150,000:

- two to ten years in prison, maximum fine of $10,000;

- Second degree felony, if the value is $150,000 or more but less than $300,000:

- two to 20 years in prison, maximum fine of $10,000;

- First degree felony, if the value is $300,000 or more:

- five to 99 years or life in prison, maximum fine of $10,000.

WHAT ARE THE PENALTIES FOR MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS?

A person charged with misapplication of fiduciary property or property of a financial institution may be eligible for probation after a conviction, or deferred adjudication without a conviction.

- What is the length of probation for misapplication of fiduciary property or property of a financial institution? If a person is convicted of a Class C misdemeanor, the only punishment is a maximum fine of $500. A person may be placed on probation for up to two years if convicted of a Class A or Class B misdemeanor.For state jail and third degree felony misapplication of fiduciary property charges, the probation term may range from two to five years, and may not exceed ten years for second degree and first degree felonies.

- What is the length of deferred adjudication for misapplication of fiduciary property or property of a financial institution? To avoid a conviction for misapplication of fiduciary property, a person may plead guilty or nolo contendere (“no contest”) to a judge, and be placed on deferred adjudication. The period of deferred adjudication may not exceed 180 days for a Class C misdemeanor, or two years for a Class A or Class B misdemeanor.The deferred adjudication term for a state jail felony is between two and five years, with the possibility of extending it up to ten years. The deferred adjudication term may not exceed ten years for first degree, second degree, and third degree felonies.

WHAT ARE THE DEFENSES TO MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS?

The statute does not authorize specific defenses to misapplication of fiduciary property or property of a financial institution. A person accused thereof may assert any defense in an attempt to negate at least one of the elements the State must prove at trial. For example, the State must show the accused was acting in a fiduciary capacity at the time of mishandling the property, so a person may argue he or she was not acting as a fiduciary.

- What is a fiduciary? A fiduciary is one who is required to act for the benefit of another person on all matters within the scope of their relationship. A fiduciary owes another a duty of good faith, trust, confidence, and candor, and must exercise a high standard of care in managing another’s property or money. Common examples of a fiduciary relationship include a trustee-beneficiary, guardian-ward, principal-agent, and attorney-client relationship. Such relationships commonly arise in one of four situations:

- when a person places trust in the faithful integrity of another, who as a result gains superiority or influence over the first;

- when one person assumes control and responsibility over another;

- when on person has a duty to act for or give advice to another on matters falling within the scope of the relationship; or

- when there is a specific relationship that has traditionally been recognized as involving fiduciary duties, as with a lawyer and a client or a stockbroker and a customer.

In Texas civil courts, everyday arms-length business transactions, including contracts to sell goods and services, generally do not give rise to a fiduciary relationship between parties. In such situations, it is assumed the parties interact for their mutual benefit, and are not expected to act solely for the benefit of the other party to the contract.

WHAT IS THE STATUTE OF LIMITATIONS FOR MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS?

The limitation period for misapplication of fiduciary property or property of a financial institution is seven years.

MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION IN TEXAS

Misapplication of fiduciary property or property of a financial institution criminalizes abusing a trusted position for financial gain, or for any other potential benefit for the fiduciary, or harm to the person for whom a fiduciary must act. For example, a lawyer holding a client’s funds may not commingle those funds with their personal accounts, a trustee may not siphon funds from a trust to pay their own bills, and so on.

TEXAS MISAPPLICATION OF FIDUCIARY PROPERTY OR PROPERTY OF FINANCIAL INSTITUTION COURT CASES

The case law regarding misapplication of fiduciary property or property of a financial institution in Texas explains the statute’s application.

- In Berry v. State, the defendant operated a shutters and blinds business franchise, and failed to deliver products for which customers already paid. Due to the aggregate amount, he was charged with third degree felony misapplication of fiduciary property, and ultimately convicted. On appeal, he argued he was not acting in a fiduciary capacity.The Court of Criminal Appeals reversed the conviction, explaining that these were everyday, arms-length business transactions. The defendant had no special relationship with his customers beyond the usual contractual relationship that exists between any seller and buyer of goods.

- The law also explains the need for the prosecution to allege the specific transactions that violated the fiduciary relationship. In State v. Moff, the State alleged only that the defendant, between 1993 and 1999, misapplied money and credit cards while acting as a fiduciary for the Nueces County Appraisal District. The trial court quashed the indictment for failing to specify which purchases were made without authorization, and the Court of Criminal Appeals agreed.