WHAT IS GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS?

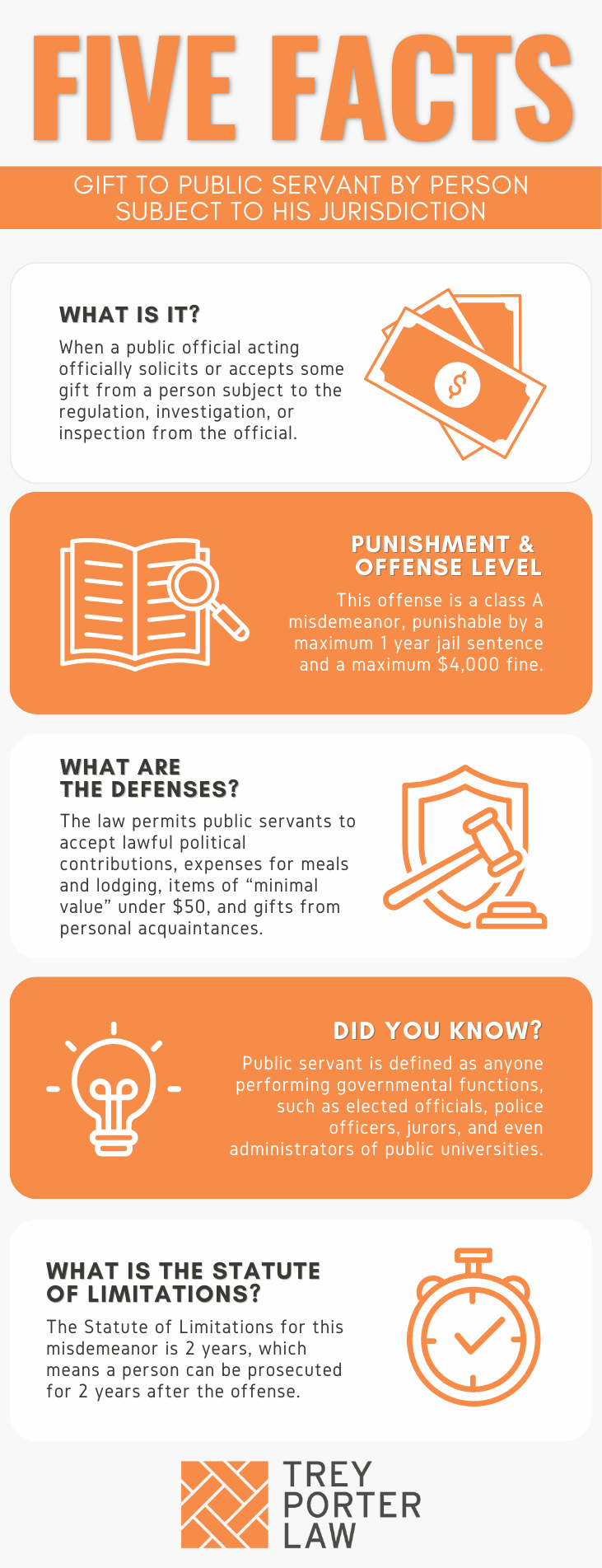

Texas law prohibits a public servant acting in his or her official capacity from soliciting, accepting, or agreeing to accept gifts or benefits from anyone subject to his or her jurisdiction or regulation. This prohibition applies to gifts and expenditures made both during and outside of working hours. The illegality thereof depends on the value of the gift, and the nature and context in which it was given.

- What is a public servant? A public servant is anyone performing a governmental function, elected officials, police officers and other first responders, jurors, and even private arbitrators or referees. For example, a vice president of a public university is considered a public servant, and may not accept any benefit from prospective public contractors, such as travel expenses and theater tickets. See Smith v. State, 959 S.W.2d 1 (Tex. App.—Waco 1997, pet. ref’d).

WHAT IS THE GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION LAW IN TEXAS?

Tex. Penal Code § 36.08. GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION.

(a) A public servant in an agency performing regulatory functions or conducting inspections or investigations commits an offense if he solicits, accepts, or agrees to accept any benefit from a person the public servant knows to be subject to regulation, inspection, or investigation by the public servant or his agency.

(b) A public servant in an agency having custody of prisoners commits an offense if he solicits, accepts, or agrees to accept any benefit from a person the public servant knows to be in his custody or the custody of his agency.

(c) A public servant in an agency carrying on civil or criminal litigation on behalf of government commits an offense if he solicits, accepts, or agrees to accept any benefit from a person against whom the public servant knows litigation is pending or contemplated by the public servant or his agency.

(d) A public servant who exercises discretion in connection with contracts, purchases, payments, claims, or other pecuniary transactions of government commits an offense if he solicits, accepts, or agrees to accept any benefit from a person the public servant knows is interested in or likely to become interested in any contract, purchase, payment, claim, or transaction involving the exercise of his discretion.

(e) A public servant who has judicial or administrative authority, who is employed by or in a tribunal having judicial or administrative authority, or who participates in the enforcement of the tribunal’s decision, commits an offense if he solicits, accepts, or agrees to accept any benefit from a person the public servant knows is interested in or likely to become interested in any matter before the public servant or tribunal.

(f) A member of the legislature, the governor, the lieutenant governor, or a person employed by a member of the legislature, the governor, the lieutenant governor, or an agency of the legislature commits an offense if he solicits, accepts, or agrees to accept any benefit from any person.

(g) A public servant who is a hearing examiner employed by an agency performing regulatory functions and who conducts hearings in contested cases commits an offense if the public servant solicits, accepts, or agrees to accept any benefit from any person who is appearing before the agency in a contested case, who is doing business with the agency, or who the public servant knows is interested in any matter before the public servant. The exception provided by § 36.10(b) does not apply to a benefit under this subsection.

(h) An offense under this section is a Class A misdemeanor.

(i) A public servant who receives an unsolicited benefit that the public servant is prohibited from accepting under this section may donate the benefit to a governmental entity that has the authority to accept the gift or may donate the benefit to a recognized tax-exempt charitable organization formed for educational, religious, or scientific purposes.

Tex. Penal Code § 36.10. NON-APPLICABLE.

(a) Sections 36.08 (Gift to Public Servant) and 36.09 (Offering Gift to Public Servant) do not apply to:

(1) a fee prescribed by law to be received by a public servant or any other benefit to which the public servant is lawfully entitled or for which he gives legitimate consideration in a capacity other than as a public servant;

(2) a gift or other benefit conferred on account of kinship or a personal, professional, or business relationship independent of the official status of the recipient;

(3) a benefit to a public servant required to file a statement under Chapter 572, Government Code, or a report under Title 15, Election Code, that is derived from a function in honor or appreciation of the recipient if:

(A) the benefit and the source of any benefit in excess of $50 is reported in the statement; and

(B) the benefit is used solely to defray the expenses that accrue in the performance of duties or activities in connection with the office which are nonreimbursable by the state or political subdivision;

(4) a political contribution as defined by Title 15, Election Code;

(5) a gift, award, or memento to a member of the legislative or executive branch that is required to be reported under Chapter 305, Government Code;

(6) an item with a value of less than $50, excluding cash or a negotiable instrument as described by Section 3.104, Business & Commerce Code;

(7) an item issued by a governmental entity that allows the use of property or facilities owned, leased, or operated by the governmental entity;

(8) transportation, lodging, and meals described by Section 36.07(b); or

(9) complimentary legal advice or legal services relating to a will, power of attorney, advance directive, or other estate planning document rendered:

(A) to a public servant who is a first responder; and

(B) through a program or clinic that is:

(i) operated by a local bar association or the State Bar of Texas; and

(ii) approved by the head of the agency employing the public servant, if the public servant is employed by an agency.

(b) Section 36.08 (Gift to Public Servant) does not apply to food, lodging, transportation, or entertainment accepted as a guest and, if the donee is required by law to report those items, reported by the donee in accordance with that law.

. . .

(d) Section 36.08 (Gift to Public Servant) does not apply to a gratuity accepted and reported in accordance with Section 11.0262, Parks and Wildlife Code.

WHAT IS THE PENALTY CLASS FOR GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS?

It is a Class A misdemeanor for a public servant to solicit a gift or benefit from anyone subject to his jurisdiction, which is punishable by up to one year in county jail.

WHAT IS THE PUNISHMENT RANGE FOR GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS?

Soliciting a gift as a public servant is a Class A misdemeanor, which carries up to one year in jail, and a maximum fine of $4,000.

WHAT ARE THE PENALTIES FOR GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS?

As an alternative to jail, a public servant convicted of soliciting gifts from people within his jurisdiction may be placed on probation for up to two years, or deferred adjudication without a conviction for up to two years.

WHAT ARE THE DEFENSES TO GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS?

The Penal Code identifies several defenses, or scenarios to which this law does not apply. Political contributions, most lodging and meal expenses, anything of “minimal value” or under $50, and gifts given and received based on personal relationships are all acceptable benefits. Public servants who are first responders may also accept free legal counsel from a clinic or program run by the State Bar or local bar association.

- What is a campaign or political contribution? The Texas Election Code defines a “contribution” to a campaign, officeholder, or political contribution as the transfer of money or any other thing of value to a political candidate or officeholder for campaign expenses or to defray non-reimbursable officeholder-related expenses. Public servants may legally solicit and accept such contributions.

WHAT IS THE STATUTE OF LIMITATIONS FOR GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS?

The limitation period for gifts to public servants by people subject to their jurisdiction, a Class A misdemeanor, is two years.

GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION IN TEXAS

Public servants are prohibited from requesting, accepting, and agreeing to accept benefits in their official capacity. This law is to deter public servants from engaging in business activities that create a conflict or appearance thereof between their official responsibilities and private contractual obligations.

TEXAS GIFT TO PUBLIC SERVANT BY PERSON SUBJECT TO HIS JURISDICTION COURT CASES

The case law regarding gift to public servant by person subject to his jurisdiction in Texas illustrates the statute’s application.

- In Smith v. State, the defendant was the Vice-President for Finance and Administration for Texas A&M University. Barnes & Noble had a contract with Texas A&M to operate the university’s bookstore. Barnes & Noble flew the defendant and his wife to their corporate office in New York, paid for their meals, lodging, air fare, and theater tickets. Because the defendant exercised discretion in purchases and contracts, and Barnes & Noble was an interested party, he was rightfully convicted of accepting a benefit under the gift to public servant law.

- In Ethics Advisory Opinion-569, the Ethics Commission advised candidates and officeholders that they may use their own political contributions to establish a general-purpose political committee (GPAC), and may control such a GPAC. The Commission warned, however, that political contributions “accepted” by a candidate-established or controlled GPAC are accepted by a person as a candidate or officeholder, and are not for personal use or paying the salary of the controlling candidate or officeholder.Personal-use restrictions notwithstanding, the Penal Code gift and honorarium restrictions would allow such employment under only a narrow set of facts, and such employment may violate the standards of conduct for a public servant.