WHAT IS TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS?

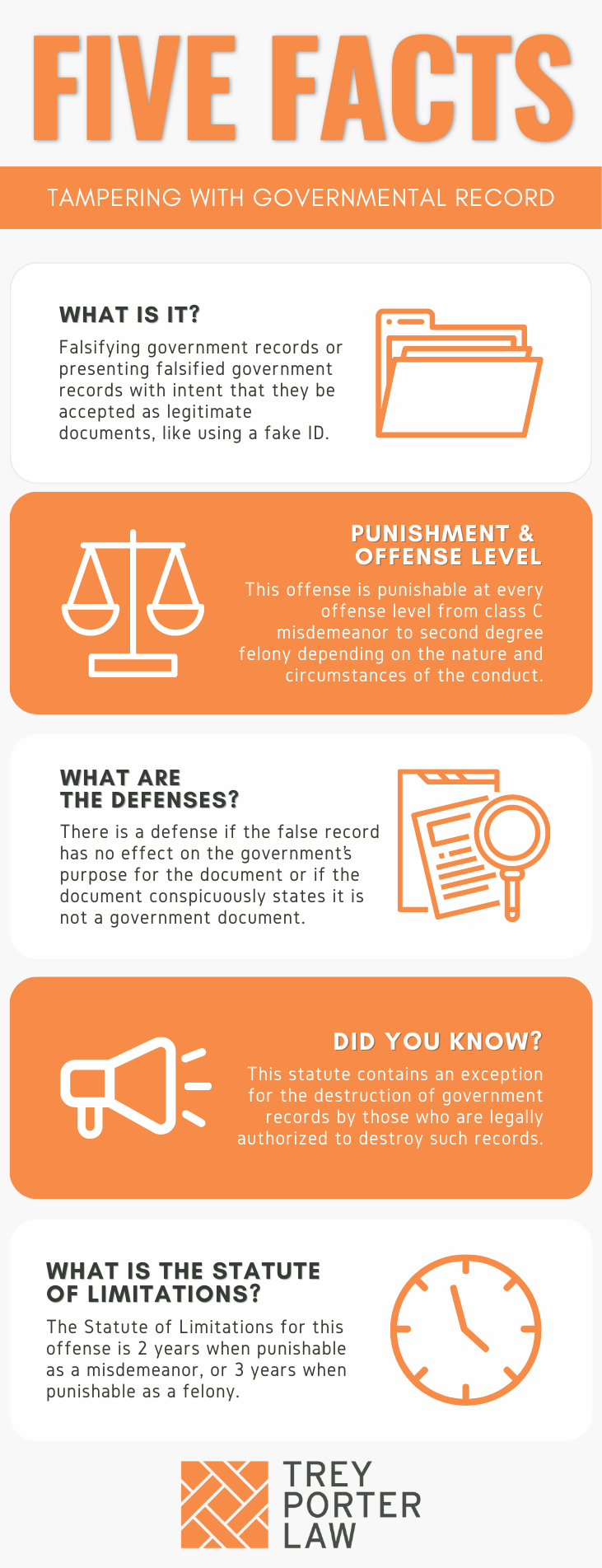

The law against tampering with a governmental record prohibits using falsified records with the intent they be taken as genuine, or using, possessing, or selling a genuine governmental record for a fraudulent purpose.

Tampering with a governmental record may be committed in one of six different ways, and the offense category depends on the type of record with which a person tampered—e.g., a license or certificate issued by the government, a ballistics or autopsy report, a document to establish a student’s residency, or an appraisal filed by an interested person—and whether the person intended to defraud or harm another.

- What is the intent to defraud or harm? “Intent to defraud” means intent to cause another to rely on the falsity of the representation, such that the other person is induced to act or refrain from acting. If a person is in possession of two or more of the same type of governmental records or blank governmental record forms, and each is a license, certificate, permit, seal, title, or similar government-issued document, the intent to defraud or harm is presumed.In the specific context of someone filing a false record with a government entity, if the State is seeking to establish a person’s intent to defraud or harm a government entity, the State must show that the government has the legal authority to require keeping of such records in order to prove that it is legally possible to defraud the government by filing a false record.

- What is a governmental record? Texas Penal Code Section 37.01 defines a “governmental record” as anything belonging to, received by, or kept by the government for information. Such records include licenses, permits, titles, proof of vehicle insurance, an official ballot or other election record, or anything else required by law to be kept by others for information of government. Examples of government records include:

-

- Social security cards, which is a certificate issued by the United States government;

- Court dockets;

- Warrants, affidavits to obtain warrants, and other record-keeping documents for police or government officials;

- Offense and incident reports created by peace officers, jailers, or other government employees;

- Written reports by experts who tested or examined physical evidence for a criminal case;

- Written certification, inspection, or maintenance records of an instrument, machine, or other device used to examine or test evidence in criminal cases;

- Any application filed with a government entity, once it is received by the government entity;

- Driver’s licenses, temporary or permanent license plates, permits, and certificates of insurance;

- Food stamps, Medicaid documentation, and applications therefor;

- Voter registration, and applications therefor;

- Public school records, reports, or assessment instruments;

- Legally required data reported to the Texas Education Agency for a school district or open-enrollment charter school.

WHAT IS THE TAMPERING WITH GOVERNMENTAL RECORD LAW IN TEXAS?

Tex. Penal Code § 37.10. TAMPERING WITH GOVERNMENTAL RECORD.

(a) A person commits an offense if he:

(1) knowingly makes a false entry in, or false alteration of, a governmental record;

(2) makes, presents, or uses any record, document, or thing with knowledge of its falsity and with intent that it be taken as a genuine governmental record;

(3) intentionally destroys, conceals, removes, or otherwise impairs the verity, legibility, or availability of a governmental record;

(4) possesses, sells, or offers to sell a governmental record or a blank governmental record form with intent that it be used unlawfully;

(5) makes, presents, or uses a governmental record with knowledge of its falsity; or

(6) possesses, sells, or offers to sell a governmental record or a blank governmental record form with knowledge that it was obtained unlawfully.

(b) It is an exception to the application of Subsection (a)(3) that the governmental record is destroyed pursuant to legal authorization or transferred under Section 441.204, Government Code. With regard to the destruction of a local government record, legal authorization includes compliance with the provisions of Subtitle C, Title 6, Local Government Code.

(c)(1) Except as provided by Subdivisions (2), (3), (4), and (5), and by Subsection (d), an offense under this section is a Class A misdemeanor unless the actor’s intent is to defraud or harm another, in which event the offense is a state jail felony.

(2) An offense under this section is a felony of the third degree if it is shown on the trial of the offense that the governmental record was:

(A) a public school record, report, or assessment instrument required under Chapter 39, Education Code, data reported for a school district or open-enrollment charter school to the Texas Education Agency through the Public Education Information Management System (PEIMS) described by Sections 48.008 and 48.009, Education Code, under a law or rule requiring that reporting, or a license, certificate, permit, seal, title, letter of patent, or similar document issued by government, by another state, or by the United States, unless the actor’s intent is to defraud or harm another, in which event the offense is a felony of the second degree;

(B) a written report of a medical, chemical, toxicological, ballistic, or other expert examination or test performed on physical evidence for the purpose of determining the connection or relevance of the evidence to a criminal action;

(C) a written report of the certification, inspection, or maintenance record of an instrument, apparatus, implement, machine, or other similar device used in the course of an examination or test performed on physical evidence for the purpose of determining the connection or relevance of the evidence to a criminal action; or

(D) a search warrant issued by a magistrate.

(3) An offense under this section is a Class C misdemeanor if it is shown on the trial of the offense that the governmental record is a governmental record that is required for enrollment of a student in a school district and was used by the actor to establish the residency of the student.

(4) An offense under this section is a Class B misdemeanor if it is shown on the trial of the offense that the governmental record is a written appraisal filed with an appraisal review board under Section 41.43(a-1), Tax Code, that was performed by a person who had a contingency interest in the outcome of the appraisal review board hearing.

(5) An offense under this section is a Class B misdemeanor if the governmental record is an application for a place on the ballot under Section 141.031, Election Code, and the actor knowingly provides false information under Subsection (a)(4)(G) of that section.

(d) An offense under this section, if it is shown on the trial of the offense that the governmental record is described by Section 37.01(2)(D), is:

(1) a Class B misdemeanor if the offense is committed under Subsection (a)(2) or Subsection (a)(5) and the defendant is convicted of presenting or using the record;

(2) a felony of the third degree if the offense is committed under:

(A) Subsection (a)(1), (3), (4), or (6); or

(B) Subsection (a)(2) or (5) and the defendant is convicted of making the record; and

(3) a felony of the second degree, notwithstanding Subdivisions (1) and (2), if the actor’s intent in committing the offense was to defraud or harm another.

(e) It is an affirmative defense to prosecution for possession under Subsection (a)(6) that the possession occurred in the actual discharge of official duties as a public servant.

(f) It is a defense to prosecution under Subsection (a)(1), (a)(2), or (a)(5) that the false entry or false information could have no effect on the government’s purpose for requiring the governmental record.

(g) A person is presumed to intend to defraud or harm another if the person acts with respect to two or more of the same type of governmental records or blank governmental record forms and if each governmental record or blank governmental record form is a license, certificate, permit, seal, title, or similar document issued by government.

(h) If conduct that constitutes an offense under this section also constitutes an offense under Section 32.48 or 37.13, the actor may be prosecuted under any of those sections.

(i) With the consent of the appropriate local county or district attorney, the attorney general has concurrent jurisdiction with that consenting local prosecutor to prosecute an offense under this section that involves the state Medicaid program.

(j) It is not a defense to prosecution under Subsection (a)(2) that the record, document, or thing made, presented, or used displays or contains the statement “NOT A GOVERNMENT DOCUMENT” or another substantially similar statement intended to alert a person to the falsity of the record, document, or thing, unless the record, document, or thing displays the statement diagonally printed clearly and indelibly on both the front and back of the record, document, or thing in solid red capital letters at least one-fourth inch in height.

WHAT IS THE PENALTY CLASS FOR TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS?

The offense category for tampering with a governmental record depends on the type of record, and whether a person intended to defraud or harm another.

By default, tampering with a governmental record is a Class A misdemeanor, punishable by up to one year in jail. If the person intended to defraud or harm another, the offense is a state jail felony, punishable by 180 days to two years in a state jail facility.

The law designates different penalty classifications for other specific types of falsified or misused governmental records:

- Class C misdemeanor, punishable by a maximum fine of $500, if:

- the governmental record is required to enroll a student in a school district, and was used to establish residency;

- Class B misdemeanor, punishable by up to 180 days in jail, if:

- the governmental record with which a person tampers is a written tax appraisal, and the person has an interest in the outcome of the review board hearing;

If a person tampers with a governmental record purporting to be evidence of motor vehicle insurance, financial responsibility, or supporting forms or documents thereof, the offense is a:

- Third degree felony, punishable by two to ten years in prison, if:

- the person made the false proof of insurance or committed tampering by any means other than simply using or presenting the governmental record;

- Second degree felony, punishable by two to 20 years in prison, if:

- the person intended to defraud or harm another by committing the offense;

- Class B misdemeanor, punishable by up to 180 days in jail, if:

- the person presented or used the false proof of insurance without any intent to defraud or harm;

Texas law creates heightened penalties for tampering with a governmental record that is likely to be used in connection with a criminal prosecution. It is a third degree felony, punishable by two to ten years in prison, to tamper with governmental records that are:

- written reports by experts who tested or examined physical evidence for a criminal case;

- written certification, inspection, or maintenance records of an instrument, machine, or other device used to examine or test evidence in criminal cases;

- search warrants issued by magistrates;

- public school records, reports, assessment instruments, or legally required data reported to the Texas Education Agency for a school district or open-enrollment charter school,

- unless the person acted with intent to defraud or harm another, in which case it becomes a second degree felony, punishable by two to 20 years in prison;

- government-issued documents such as a license, certificate, permit, seal, title, letter of patent, or similar document,

- unless the person acted with intent to defraud or harm another, in which case it becomes a second degree felony, punishable by two to 20 years in prison.

WHAT IS THE PUNISHMENT RANGE FOR TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS?

Tampering with a governmental record may be punishable as any grade of misdemeanor, state jail felony, third degree felony, or second degree felony.

- Class C misdemeanor: maximum $500 fine, no jail time;

- Class B misdemeanor: up to 180 days in jail, maximum $2,000 fine;

- Class A misdemeanor: up to one year in jail, maximum $4,000 fine;

- State jail felony: 180 days to two years in a state jail facility, maximum $10,000 fine;

- Third degree felony: two to ten years in prison, maximum $10,000 fine;

- Second degree felony: two to 20 years in prison, maximum $10,000 fine.

WHAT ARE THE PENALTIES FOR TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS?

A person charged with tampering with a governmental record may be eligible for probation after a conviction, or deferred adjudication without a conviction. The maximum period of supervision for a second degree or third degree felony tampering charge is ten years.

For a state jail felony, the community supervision term may range between two and five years, with the possibility of extending supervision for up to ten years.

The maximum community supervision term for a Class A or Class B misdemeanor is two years, and 180 days for a Class C misdemeanor.

WHAT ARE THE DEFENSES TO TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS?

If a person is accused of knowingly making a false entry in a governmental record, or making, presenting, or using a false governmental record as a genuine one, the statute provides a defense if a false entry or false information could have no effect on the government’s purpose for requiring the governmental record.

The statute further provides a defense for a person accused of making, presenting, or using a false government record if the record displays, “NOT A GOVERNMENT DOCUMENT,” or other similar statement clearly on both the front and back of the document or record.

The law specifically provides an exception to the provision against destroying government records for those who are legally authorized to destroy such records.

WHAT IS THE STATUTE OF LIMITATIONS FOR TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS?

The limitation period for tampering with a governmental record charged as a Class A, Class B, or Class C misdemeanor is two years. If it is charged as a second degree or third degree felony, the limitation period is three years.

TAMPERING WITH GOVERNMENTAL RECORD IN TEXAS

By enacting Section 37.10, the Legislature intended to prevent a multitude of harms, including the destruction of governmental records, the perpetration of a fraud upon the court, and the miscarriage of justice that could result from the use of falsified records. The tampering with a governmental record statute outlaws numerous acts of fraud, perjury, and falsification.

TEXAS TAMPERING WITH GOVERNMENTAL RECORD COURT CASES

The case law regarding tampering with a governmental record in Texas explains the differences between each manner of committing the offense, as well as the intent to defraud or harm.

- In Chambers v. State, a police chief filed fraudulent records certifying his reserve volunteer officers underwent firearms-proficiency qualification. He was convicted of tampering with governmental records with intent to defraud or harm the Texas Commission on Law Enforcement, the government entity with whom he filed the false records.The conviction was overturned, because the law did not require the officers to have firearms-proficiency qualifications, and if TCOLE had no authority to require those qualifications, it was not induced to act based on the deceit.

- In Alfaro-Jimenez v. State, the Court of Criminal Appeals explained the necessary charging distinction between using a real government record and a fake one. The defendant was arrested with a fake social security card, and was convicted of making, using, or presenting a governmental record with knowledge of its falsity under Subsection (a)(4) and (a)(5).The Court overturned the conviction, because the charged offense required proof the defendant used a real government record, not a fake one. Had he been charged with knowingly using a false record with intent that it be taken as a genuine governmental record under Subsection (a)(2), the conviction would have been affirmed.