WHAT IS THEFT IN TEXAS?

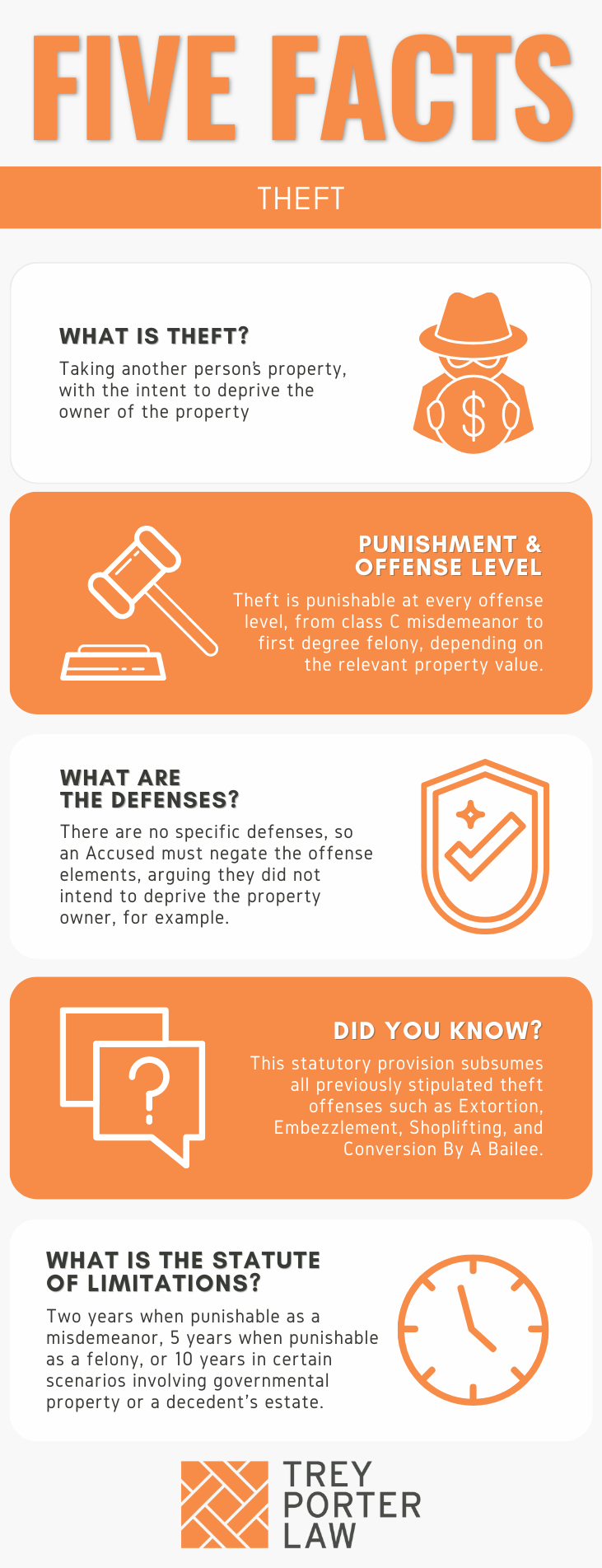

The Texas law against theft prohibits unlawfully appropriating property with intent to deprive the owner of the property. Theft in Texas describes several crimes beyond just stealing another’s property, including receiving stolen property, shoplifting, embezzlement, theft by false pretext, extortion, receiving or concealing embezzled property, and issuing a worthless check.

- What does it mean to “appropriate” property? Texas Penal Code Section 31.01 defines “appropriate” as “to bring about a transfer or purported transfer of title to or other nonpossessory interest in property, whether to the actor or another, or to acquire or otherwise exercise control over property other than real property.”Unlawfully appropriating property includes taking another’s property, or receiving stolen property knowing it was stolen. A person’s unexplained possession of recently stolen property supports a theft conviction. See, e.g., Mottin v. State, 634 S.W.3d 761 (Tex. App.—Houston [1st Dist.] 2020, pet. ref’d).

WHAT IS THE THEFT LAW IN TEXAS?

Tex. Penal Code § 31.03. THEFT.

(a) A person commits an offense if he unlawfully appropriates property with intent to deprive the owner of property.

(b) Appropriation of property is unlawful if:

(1) it is without the owner’s effective consent;

(2) the property is stolen and the actor appropriates the property knowing it was stolen by another; or

(3) property in the custody of any law enforcement agency was explicitly represented by any law enforcement agent to the actor as being stolen and the actor appropriates the property believing it was stolen by another.

(c) For purposes of Subsection (b):

(1) evidence that the actor has previously participated in recent transactions other than, but similar to, that which the prosecution is based is admissible for the purpose of showing knowledge or intent and the issues of knowledge or intent are raised by the actor’s plea of not guilty;

(2) the testimony of an accomplice shall be corroborated by proof that tends to connect the actor to the crime, but the actor’s knowledge or intent may be established by the uncorroborated testimony of the accomplice;

(3) an actor engaged in the business of buying and selling used or secondhand personal property, or lending money on the security of personal property deposited with the actor, is presumed to know upon receipt by the actor of stolen property (other than a motor vehicle subject to Chapter 501, Transportation Code) that the property has been previously stolen from another if the actor pays for or loans against the property $25 or more (or consideration of equivalent value) and the actor knowingly or recklessly:

(A) fails to record the name, address, and physical description or identification number of the seller or pledgor;

(B) fails to record a complete description of the property, including the serial number, if reasonably available, or other identifying characteristics; or

(C) fails to obtain a signed warranty from the seller or pledgor that the seller or pledgor has the right to possess the property. It is the express intent of this provision that the presumption arises unless the actor complies with each of the numbered requirements;

. . .

(6) an actor engaged in the business of obtaining abandoned or wrecked motor vehicles or parts of an abandoned or wrecked motor vehicle for resale, disposal, scrap, repair, rebuilding, demolition, or other form of salvage is presumed to know on receipt by the actor of stolen property that the property has been previously stolen from another if the actor knowingly or recklessly:

(A) fails to maintain an accurate and legible inventory of each motor vehicle component part purchased by or delivered to the actor, including the date of purchase or delivery, the name, age, address, sex, and driver’s license number of the seller or person making the delivery, the license plate number of the motor vehicle in which the part was delivered, a complete description of the part, and the vehicle identification number of the motor vehicle from which the part was removed, or in lieu of maintaining an inventory, fails to record the name and certificate of inventory number of the person who dismantled the motor vehicle from which the part was obtained;

(B) fails on receipt of a motor vehicle to obtain a certificate of authority, sales receipt, or transfer document as required by Chapter 683, Transportation Code, or a certificate of title showing that the motor vehicle is not subject to a lien or that all recorded liens on the motor vehicle have been released; or

(C) fails on receipt of a motor vehicle to immediately remove an unexpired license plate from the motor vehicle, to keep the plate in a secure and locked place, or to maintain an inventory, on forms provided by the Texas Department of Motor Vehicles, of license plates kept under this paragraph, including for each plate or set of plates the license plate number and the make, motor number, and vehicle identification number of the motor vehicle from which the plate was removed;

(7) an actor who purchases or receives a used or secondhand motor vehicle is presumed to know on receipt by the actor of the motor vehicle that the motor vehicle has been previously stolen from another if the actor knowingly or recklessly:

(A) fails to report to the Texas Department of Motor Vehicles the failure of the person who sold or delivered the motor vehicle to the actor to deliver to the actor a properly executed certificate of title to the motor vehicle at the time the motor vehicle was delivered; or

(B) fails to file with the county tax assessor-collector of the county in which the actor received the motor vehicle, not later than the 20th day after the date the actor received the motor vehicle, the registration license receipt and certificate of title or evidence of title delivered to the actor in accordance with Subchapter D, Chapter 520, Transportation Code, at the time the motor vehicle was delivered;

(8) an actor who purchases or receives from any source other than a licensed retailer or distributor of pesticides a restricted-use pesticide or a state-limited-use pesticide or a compound, mixture, or preparation containing a restricted-use or state-limited-use pesticide is presumed to know on receipt by the actor of the pesticide or compound, mixture, or preparation that the pesticide or compound, mixture, or preparation has been previously stolen from another if the actor:

(A) fails to record the name, address, and physical description of the seller or pledgor;

(B) fails to record a complete description of the amount and type of pesticide or compound, mixture, or preparation purchased or received; and

(C) fails to obtain a signed warranty from the seller or pledgor that the seller or pledgor has the right to possess the property; and

(9) an actor who is subject to Section 409, Packers and Stockyards Act (7 U.S.C. Section 228b), that obtains livestock from a commission merchant by representing that the actor will make prompt payment is presumed to have induced the commission merchant’s consent by deception if the actor fails to make full payment in accordance with Section 409, Packers and Stockyards Act (7 U.S.C. Section 228b).

(d) It is not a defense to prosecution under this section that:

(1) the offense occurred as a result of a deception or strategy on the part of a law enforcement agency, including the use of an undercover operative or peace officer;

(2) the actor was provided by a law enforcement agency with a facility in which to commit the offense or an opportunity to engage in conduct constituting the offense; or

(3) the actor was solicited to commit the offense by a peace officer, and the solicitation was of a type that would encourage a person predisposed to commit the offense to actually commit the offense, but would not encourage a person not predisposed to commit the offense to actually commit the offense

(e) Except as provided by Subsection (f), an offense under this section is:

(1) a Class C misdemeanor if the value of the property stolen is less than $100;

(2) a Class B misdemeanor if:

(A) the value of the property stolen is $100 or more but less than $750;

(B) the value of the property stolen is less than $100 and the defendant has previously been convicted of any grade of theft; or

(C) the property stolen is a driver’s license, commercial driver’s license, or personal identification certificate issued by this state or another state;

(3) a Class A misdemeanor if the value of the property stolen is $750 or more but less than $2,500;

(4) a state jail felony if:

(A) the value of the property stolen is $2,500 or more but less than $30,000, or the property is less than 10 head of sheep, swine, or goats or any part thereof under the value of $30,000;

(B) regardless of value, the property is stolen from the person of another or from a human corpse or grave, including property that is a military grave marker;

(C) the property stolen is a firearm, as defined by Section 46.01;

(D) the value of the property stolen is less than $2,500 and the defendant has been previously convicted two or more times of any grade of theft;

(E) the property stolen is an official ballot or official carrier envelope for an election; or

(F) the value of the property stolen is less than $20,000 and the property stolen is:

(i) aluminum;

(ii) bronze;

(iii) copper; or

(iv) brass;

(5) a felony of the third degree if the value of the property stolen is $30,000 or more but less than $150,000, or the property is:

(A) cattle, horses, or exotic livestock or exotic fowl as defined by Section 142.001, Agriculture Code, stolen during a single transaction and having an aggregate value of less than $150,000;

(B) 10 or more head of sheep, swine, or goats stolen during a single transaction and having an aggregate value of less than $150,000; or

(C) a controlled substance, having a value of less than $150,000, if stolen from:

(i) a commercial building in which a controlled substance is generally stored, including a pharmacy, clinic, hospital, nursing facility, or warehouse; or

(ii) a vehicle owned or operated by a wholesale distributor of prescription drugs;

(6) a felony of the second degree if:

(A) the value of the property stolen is $150,000 or more but less than $300,000; or

(B) the value of the property stolen is less than $300,000 and the property stolen is an automated teller machine or the contents or components of an automated teller machine; or

(7) a felony of the first degree if the value of the property stolen is $300,000 or more.

(f) An offense described for purposes of punishment by Subsections (e)(1)-(6) is increased to the next higher category of offense if it is shown on the trial of the offense that:

(1) the actor was a public servant at the time of the offense and the property appropriated came into the actor’s custody, possession, or control by virtue of his status as a public servant;

(2) the actor was in a contractual relationship with government at the time of the offense and the property appropriated came into the actor’s custody, possession, or control by virtue of the contractual relationship;

(3) the owner of the property appropriated was at the time of the offense:

(A) an elderly individual; or

(B) a nonprofit organization;

(4) the actor was a Medicare provider in a contractual relationship with the federal government at the time of the offense and the property appropriated came into the actor’s custody, possession, or control by virtue of the contractual relationship; or

(5) during the commission of the offense, the actor intentionally, knowingly, or recklessly:

(A) caused a fire exit alarm to sound or otherwise become activated;

(B) deactivated or otherwise prevented a fire exit alarm or retail theft detector from sounding; or

(C) used a shielding or deactivation instrument to prevent or attempt to prevent detection of the offense by a retail theft detector.

. . .

(j) With the consent of the appropriate local county or district attorney, the attorney general has concurrent jurisdiction with that consenting local prosecutor to prosecute an offense under this section that involves the state Medicaid program.

Tex. Penal Code § 31.08. VALUE.

(a) Subject to the additional criteria of Subsections (b) and (c), value under this chapter is:

(1) the fair market value of the property or service at the time and place of the offense; or

(2) if the fair market value of the property cannot be ascertained, the cost of replacing the property within a reasonable time after the theft.

(b) The value of documents, other than those having a readily ascertainable market value, is:

(1) the amount due and collectible at maturity less that part which has been satisfied, if the document constitutes evidence of a debt; or

(2) the greatest amount of economic loss that the owner might reasonably suffer by virtue of loss of the document, if the document is other than evidence of a debt.

(c) If property or service has value that cannot be reasonably ascertained by the criteria set forth in Subsections (a) and (b), the property or service is deemed to have a value of $750 or more but less than $2,500.

(d) If the actor proves by a preponderance of the evidence that he gave consideration for or had a legal interest in the property or service stolen, the amount of the consideration or the value of the interest so proven shall be deducted from the value of the property or service ascertained under Subsection (a), (b), or (c) to determine value for purposes of this chapter.

WHAT IS THE PENALTY CLASS FOR THEFT IN TEXAS?

The penalty class for a theft charge depends on the character and value of the appropriated property, and whether the person has prior theft convictions. Theft is a:

- Class C misdemeanor, punishable by a maximum $500 fine, if:

- the value is less than $100;

- Class B misdemeanor, punishable by up to 180 days in county jail, if:

- the value is $100 to $749;

- the value is less than $100, and one prior theft conviction; or

- the stolen property is a state-issued driver’s license, commercial driver’s license, or personal identification certificate;

- Class A misdemeanor, punishable by up to one year in county jail, if:

- the value is $750 to $2,499;

- State jail felony, punishable by 180 days to two years in a state jail facility, if:

- the value is $2,500 to $29,999; or

- the value is less than $2,500, and the person has at least two prior theft convictions;

- the stolen property is:

- aluminum, bronze, copper, or brass with a value of less than $20,000;

- a firearm;

- an official ballot or official carrier envelope for an election;

- livestock with a value of less than $30,000; or

- the person stole property directly from another’s physical grasp, immediate possession, or body;

- the person stole property from a human corpse, grave, or military grave marker.

- Third degree felony, punishable by two to ten years in prison, if:

- the value is $30,000 to $149,999; or

- the stolen property is:

- livestock with a value of less than $150,000; or

- a controlled substance with a value of less than $150,000, stolen from a place authorized to store and distribute controlled substances or prescription drugs;

- Second degree felony, punishable by two to 20 years in prison, if:

- the value is $150,000 to $299,999; or

- the stolen property is an ATM or its components, with a value of less than $300,000;

- First degree felony, punishable by five to 99 years or life in prison, if:

- the value is over $300,000.

Texas law further enhances theft penalties based on the person’s or theft victim’s status. If one of the following factors applies, the theft charge is enhanced to the next highest penalty classification:

- Theft by a public servant who used his or her status to commit the theft;

- Theft from the government by a government contractor;

- Theft from a nonprofit organization or elderly person;

- Theft by a Medicare provider in a contractual relationship with the federal government;

- If, during the commission of the theft, the person:

- activates a fire exit alarm;

- deactivates or otherwise prevents a fire exit alarm or retail theft detector from sounding; or

- uses or attempts to use an instrument to shield or deactivate a retail theft detector.

Texas Penal Code Section 12.50 increases the penalty classification for theft to the next highest category, or to minimum confinement of 180 days in jail if the theft is a Class A misdemeanor, if a person commits the offense in an area subject to an emergency evacuation order, or under a declaration of a state of disaster by the governor or president of the United States.

WHAT IS THE PUNISHMENT RANGE FOR THEFT IN TEXAS?

The punishment range for theft increases with the value of the stolen property. Theft is also “enhanceable” by prior convictions. The punishment ranges for theft are:

- Class C misdemeanor, if the value is less than $100:

- maximum fine of $500, no jail time;

- Class B misdemeanor, if the value is $100 or more but less than $750:

- up to 180 days in jail, maximum fine of $2,000;

- Class A misdemeanor, if the value is $750 or more but less than $2,500:

- up to one year in jail, maximum fine of $4,000;

- State jail felony, if the value is $2,500 or more but less than $30,000, or less than $2,500 and the person has two prior convictions, or the stolen property or conduct constitutes a state jail felony offense:

- 180 days to two years in a state jail facility, maximum fine of $10,000;

- Third degree felony, if the value is $30,000 or more but less than $150,000, or the stolen property a controlled substance or livestock:

- two to ten years in prison, maximum fine of $10,000;

- Second degree felony, if the value is $150,000 or more but less than $300,000, or the property stolen is an ATM:

- two to 20 years in prison, maximum fine of $10,000;

- First degree felony, if the value is $300,000 or more:

- five to 99 years or life in prison, maximum fine of $10,000.

WHAT ARE THE PENALTIES FOR THEFT IN TEXAS?

A person charged with theft may be eligible for probation after a conviction, or deferred adjudication without a conviction. The period of community supervision depends on the offense category.

There is no community supervision required after a Class C misdemeanor conviction, but a person charged with a Class C misdemeanor theft may be placed on deferred adjudication for up to 180 days.

The period of community supervision for Class A or Class B misdemeanors may not exceed two years.

The period of community supervision for a state jail felony theft is from two to five years, with the possibility of extending supervision for up to ten years.

For a third degree felony theft charge, a person may be placed on deferred adjudication for up to ten years, or probation for a period between two and five years.

The period of community supervision for first degree felony and second degree felony theft charges may not exceed ten years. A judge may also order up to 180 days in jail as a condition of community supervision.

WHAT ARE THE DEFENSES TO THEFT IN TEXAS?

The Texas theft statute does not authorize specific defenses to theft. A person accused thereof may attempt to negate one of the elements the State must prove at trial.

- Can a contractor who fails to perform be charged with theft? To prove a person is guilty of theft in connection with a contract, the State must show the appropriation was a result of false pretext, or fraud, and that the accused intended to deprive the owner of the property at the time the property was taken.In Wirth v. State, the defendant’s company bought cars from dealerships to lease to customers. In facilitating transactions, the defendant and his employees issued sight orders, or promises to pay, to dealerships in exchange for the cars. The defendant closed his bank accounts and his business, and various dealerships discovered they had unpaid sight orders with face values totaling over $500,000.The defendant was convicted of theft, and the Court of Criminal Appeals affirmed. In the year before the defendant closed his business, his bank’s account manager frequently told him he lacked funds to cover the issued sight orders. There was enough circumstantial evidence showing he had no intention of paying the dealerships when he entered into the agreements.

- What is theft by deception? In Texas, unlawfully appropriating property is without the owner’s consent if the owner was deceived. Texas Penal Code Section 31.01 defines “deception” as:

- creating or confirming a false impression;

- failing to correct a false impression;

- preventing another from acquiring information;

- selling or otherwise transferring or encumbering property without disclosing a lien, security interest, adverse claim, or other legal impediment; or

- promising a performance with no intent to perform or that will not be performed.

The deceptive act must have induced the owner to transfer property—i.e., the deception must have preceded the consent given.

In Fernandez v. State, Val Verde County paid for a judge’s flight to attend a conference. He ultimately canceled the trip in return for a ticket voucher, and let his son use the voucher for personal travel. A jury convicted the judge of theft by deception, and the Court of Criminal Appeals affirmed. The voucher was county property, and despite consenting to purchase the ticket for the judge, the county’s consent was for county-approved travel, not personal travel for the judge’s son.

- What is theft by coercion? A person commits theft by coercion by depriving another of their property by threatening to commit an act other than imminent bodily injury, which would elevate the theft to robbery. Blackmail is a form of theft by coercion.Texas Penal Code Section 1.07(9) defines “coercion” as a threat to: (1) commit an offense; (2) inflict bodily injury in the future on the person threatened or another; (3) accuse a person of any offense; (4) expose a person to hatred, contempt, or ridicule; (5) harm the credit or business repute of any person; or take or withhold action as a public severance or cause a public servant to take or withhold action.In Evans v. State, a psychic told people bad fortune would befall their loved ones if they did not hand over money, merchandise, and gift cards to her and some of her relatives. She harassed her clients until some of them had cleared their bank accounts and were far over their heads in loan and credit card debt. The State charged her with theft by coercion, and she was convicted. The appellate court reversed the conviction, explaining theft by coercion required some sort of threat. Had she been charged with theft by deception, her conviction would have been affirmed.

- Can a person raise an entrapment defense to theft? Texas Penal Code Section 8.06 requires a person to show he or she was induced or caused to commit an offense by law enforcement. But Subsection (d) of the theft statute forecloses most arguments supporting an entrapment defense. It is no defense to theft that the theft occurred because of deception or strategy by law enforcement, including undercover police, or that law enforcement provided the accused a facility to commit theft, or solicited the accused to commit theft.

WHAT IS THE STATUTE OF LIMITATIONS FOR THEFT IN TEXAS?

The limitation period for felony theft is five years under most circumstances, and the limitations period for misdemeanor theft is two years.

The limitation period is ten years for:

- theft of government property by a public servant who had control over the property in his or her official capacity; or

- theft of any part of an estate by an executor, administrator, guardian, or trustee with intent to defraud any creditor, heir, legatee, ward, distributee, beneficiary, or settlor of a trust interested in the estate.

THEFT IN TEXAS

In Texas, theft is broadly defined as the unlawful appropriation of another’s property with intent to deprive the owner. Appropriation is unlawful if it is without the owner’s effective consent, which includes situations in which one is deceived into giving his or her property to another person. Theft includes stealing another’s property, receiving stolen property, or fooling another into willingly relinquishing property.

TEXAS THEFT COURT CASES

The case law regarding theft in Texas shows the statute’s broad application to a variety of conduct.

- In Mottin v. State, the victim’s airboat was stolen, and the defendant was found with it two weeks later. He told police he bought it from someone a few weeks prior, but did not have the title. The defendant was convicted of theft, and the appellate court affirmed. Unexplained possession of recently stolen property is sufficient proof of unlawful appropriation without the owner’s effective consent, thus permitting an inference of guilt.