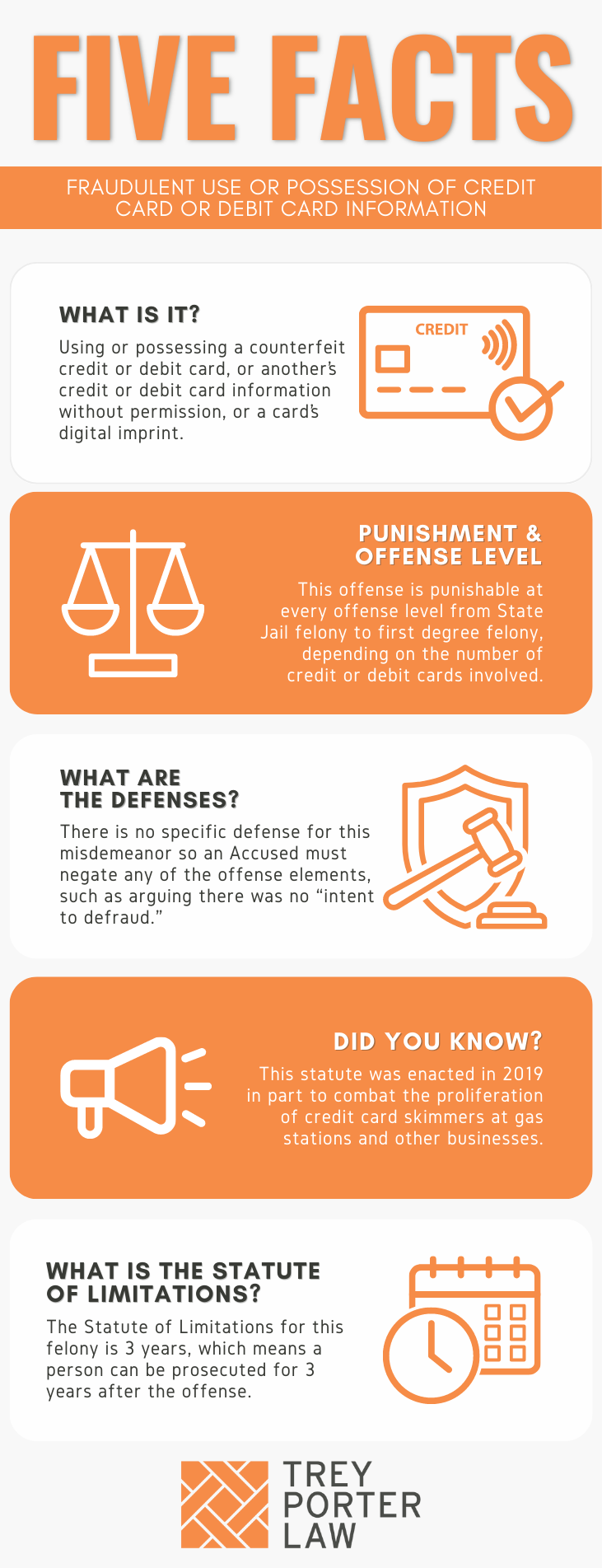

WHAT IS FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS?

The law against fraudulent use or possession of credit card or debit card information penalizes a person who uses or is in possession of another’s credit or debit card information without permission, a counterfeit credit card, or data stored on the card’s “digital imprint.”

WHAT IS THE FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION LAW IN TEXAS?

Tex. Penal Code § 32.315. FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION.

(b) A person commits an offense if the person, with the intent to harm or defraud another, obtains, possesses, transfers, or uses:

(1) a counterfeit credit card or debit card;

(2) the number and expiration date of a credit card or debit card without the consent of the account holder; or

(3) the data stored on the digital imprint of a credit card or debit card without the consent of the account holder.

(c) If an actor possessed five or more of an item described by Subsection (b)(2) or (3), a rebuttable presumption exists that the actor possessed each item without the consent of the account holder.

(d) The presumption established under Subsection (c) does not apply to a business or other commercial entity or a government agency that is engaged in a business activity or governmental function that does not violate a penal law of this state.

(e) An offense under this section is:

(1) a state jail felony if the number of items obtained, possessed, transferred, or used is less than five;

(2) a felony of the third degree if the number of items obtained, possessed, transferred, or used is five or more but less than 10;

(3) a felony of the second degree if the number of items obtained, possessed, transferred, or used is 10 or more but less than 50; or

(4) a felony of the first degree if the number of items obtained, possessed, transferred, or used is 50 or more.

(f) If a court orders a defendant convicted of an offense under this section to make restitution to a victim of the offense, the court may order the defendant to reimburse the victim for lost income or other expenses, other than attorney’s fees, incurred as a result of the offense.

(g) If conduct that constitutes an offense under this section also constitutes an offense under any other law, the actor may be prosecuted under this section, the other law, or both.

WHAT IS THE PENALTY CLASS FOR FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS?

The penalty category for fraudulent use or possession of credit card or debit card information depends on the number of cards, card information, or digital imprints a person possesses. If a person has:

- one to four items:

- state jail felony, punishable by 180 days to two years in a state jail facility;

- five to nine items:

- third degree felony, punishable by two to ten years in prison;

- ten to 49 items:

- second degree felony, punishable by two to 20 years in prison;

- 50 or more items:

- first degree felony, punishable by five to 99 years or life in prison.

WHAT IS THE PUNISHMENT RANGE FOR FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS?

The punishment range for fraudulent use or possession of credit card or debit card information charged as a first degree felony is five to 99 years or life in prison. The maximum fine for all felony charges is $10,000. For a second degree felony, the prison sentence may range from two to 20 years, and a third degree felony carries between two to ten years in prison. Fraudulent use or possession of credit card or debit card information charged as a state jail felony carries between 180 days and two years in a state jail facility.

WHAT ARE THE PENALTIES FOR FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS?

A person charged with fraudulent use or possession of credit card or debit card information may be eligible for probation after a conviction, or deferred adjudication without a conviction.

- What is the length of probation for fraudulent use or possession of credit card or debit card information in Texas? A person is eligible for probation from a jury after being found guilty only if he or she has no prior felony convictions, and is sentenced to less than ten years in prison. A person who pleads guilty or nolo contendere (“no contest”) to a judge may be placed on probation at the judge’s discretion.For state jail and third degree felony fraud convictions, the period of probation may range between two and five years. The probation term may not exceed ten years if the person is convicted of a second degree or first degree felony.

- What is the length of deferred adjudication for fraudulent use or possession of credit card or debit card information in Texas? A person may avoid a conviction and be placed on deferred adjudication after pleading guilty or nolo contendere (“no contest”) to a judge.For a state jail felony, the deferred adjudication term will be between two and five years, with the possibility of extending it for up to ten years. For first degree, second degree, and third degree felonies, the deferred adjudication period may not exceed ten years.

WHAT ARE THE DEFENSES TO FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS?

The State, as part of its case, must show the accused possessed or acquired the credit or debit cards or other items with “intent to harm or defraud another.” A person on trial for fraudulent use or possession of credit card or debit card information may assert they lacked this requisite intent to commit the crime.

- What is “the intent to harm or defraud”? The intent to harm or defraud is not defined in the Penal Code, but is given its plain meaning, and may be inferred from the circumstances and common sense.In Singh v. State, a defendant who was stalking a victim broke into her home. Police caught him with her mail, and computer drives. He had apparently opened an account with a credit monitoring company in her name, and was convicted of fraudulent use or possession of identifying information. The account application had the victim’s name, date of birth, address, and social security number. She testified she believed, based on her experience with the defendant, he intended to harm her, which was sufficient to uphold the conviction.

WHAT IS THE STATUTE OF LIMITATIONS FOR FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS?

The limitation period for fraudulent use or possession of credit card or debit card information is three years.

FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION IN TEXAS

Texas law prohibits possessing another’s credit or debit card information with the intent to use it in any manner. The Texas Legislature enacted this law in 2019 to punish credit card skimming, and individuals found with multiple counterfeit cards and numerous account numbers of others.

TEXAS FRAUDULENT USE OR POSSESSION OF CREDIT CARD OR DEBIT CARD INFORMATION COURT CASES

The case law regarding fraudulent use or possession of credit or debit card information in Texas shows courts analyzing the criminalized conduct under charges for fraudulent use or possession of identifying information. The law against fraudulent use or possession of credit or debit card information is relatively new, so prosecuting offices charged the conduct under previously enacted laws.

- In Ramirez-Memije v. State, the defendant received a credit card skimmer from one person, and delivered it to another in exchange for cash, who skimmed credit card numbers from customers at a restaurant before returning it to the defendant. The police caught the waiter who used the device, who then set up the defendant. When police seized the skimmer from the defendant, it contained several items of identifying information. At trial, despite the defendant’s assertion that he did not know the skimmer contained identifying information, a jury found him guilty.