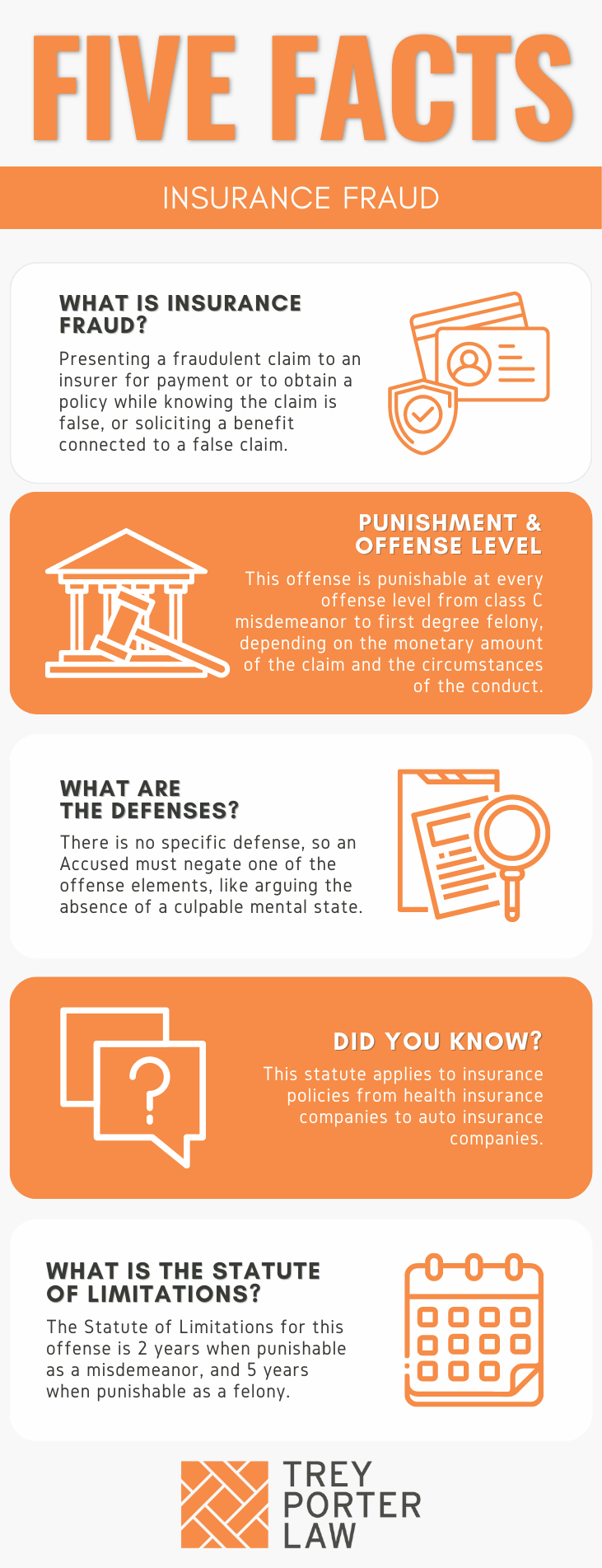

WHAT IS INSURANCE FRAUD IN TEXAS?

The Texas law against insurance fraud prohibits: (1) presenting a materially false or misleading statement in support of a claim for payment under an insurance policy; (2) receiving or soliciting a benefit in connection with a fraudulent claim made under an insurance policy; or (3) presenting a materially false or misleading statement in support of an application for an insurance policy.

WHAT IS THE INSURANCE FRAUD LAW IN TEXAS?

Tex. Penal Code § 35.02. INSURANCE FRAUD.

(a) A person commits an offense if, with intent to defraud or deceive an insurer, the person, in support of a claim for payment under an insurance policy:

(1) prepares or causes to be prepared a statement that:

(A) the person knows contains false or misleading material information; and

(B) is presented to an insurer; or

(2) presents or causes to be presented to an insurer a statement that the person knows contains false or misleading material information.

(a-1) A person commits an offense if the person, with intent to defraud or deceive an insurer and in support of an application for an insurance policy:

(1) prepares or causes to be prepared a statement that:

(A) the person knows contains false or misleading material information; and

(B) is presented to an insurer; or

(2) presents or causes to be presented to an insurer a statement that the person knows contains false or misleading material information.

(b) A person commits an offense if, with intent to defraud or deceive an insurer, the person solicits, offers, pays, or receives a benefit in connection with the furnishing of goods or services for which a claim for payment is submitted under an insurance policy.

(c) An offense under Subsection (a) or (b) is:

(1) a Class C misdemeanor if the value of the claim is less than $100;

(2) a Class B misdemeanor if the value of the claim is $100 or more but less than $750;

(3) a Class A misdemeanor if the value of the claim is $750 or more but less than $2,500;

(4) a state jail felony if the value of the claim is $2,500 or more but less than $30,000;

(5) a felony of the third degree if the value of the claim is $30,000 or more but less than $150,000;

(6) a felony of the second degree if the value of the claim is $150,000 or more but less than $300,000; or

(7) a felony of the first degree if:

(A) the value of the claim is $300,000 or more; or

(B) an act committed in connection with the commission of the offense places a person at risk of death or serious bodily injury.

(d) An offense under Subsection (a-1) is a state jail felony.

(e) The court shall order a defendant convicted of an offense under this section to pay restitution, including court costs and attorney’s fees, to an affected insurer.

(f) If conduct that constitutes an offense under this section also constitutes an offense under any other law, the actor may be prosecuted under this section, the other law, or both.

(g) For purposes of this section, if the actor proves by a preponderance of the evidence that a portion of the claim for payment under an insurance policy resulted from a valid loss, injury, expense, or service covered by the policy, the value of the claim is equal to the difference between the total claim amount and the amount of the valid portion of the claim.

(h) If it is shown on the trial of an offense under this section that the actor submitted a bill for goods or services in support of a claim for payment under an insurance policy to the insurer issuing the policy, a rebuttable presumption exists that the actor caused the claim for payment to be prepared or presented.

WHAT IS THE PENALTY CLASS FOR INSURANCE FRAUD IN TEXAS?

The penalty classification for insurance fraud committed by presenting a false or misleading statement in an application for an insurance policy is a state jail felony, punishable by 180 days to two years in a state jail facility. If a person commits insurance fraud in connection with a claim for payment under a policy, the penalty category depends on the value of the claim:

- Class C misdemeanor, punishable by a maximum $500 fine, if:

- the value of the claim is less than $100;

- Class B misdemeanor, punishable by up to 180 days in county jail, if:

- the value of the claim is $100 or more but less than $750;

- Class A misdemeanor, punishable by up to one year in county jail, if:

- the value of the claim is $750 or more but less than $2,500;

- State jail felony, punishable by 180 days to two years in a state jail facility, if:

- the value of the claim is $2,500 or more but less than $30,000;

- Third degree felony, punishable by two to ten years in prison, if:

- the value of the claim is $30,000 or more but less than $150,000;

- Second degree felony, punishable by two to 20 years in prison, if:

- the value of the claim is $150,000 or more but less than $300,000;

- First degree felony, punishable by five to 99 years in prison, if:

- the value of the claim is $300,000 or more; or

- the person’s conduct places a person at risk of death or serious bodily injury.

WHAT IS THE PUNISHMENT RANGE FOR INSURANCE FRAUD IN TEXAS?

The punishment range for insurance fraud corresponds to the conduct and the value of the claim.

- First degree felony: five to 99 years or life in prison, maximum $10,000 fine;

- Second degree felony: two to 20 years in prison, maximum $10,000 fine;

- Third degree felony: two to ten years in prison, maximum $10,000 fine;

- State jail felony: 180 days to two years in a state jail facility, maximum $10,000 fine;

- Class A misdemeanor: up to one year in jail, maximum $4,000 fine;

- Class B misdemeanor: up to 180 days in jail, maximum $2,000 fine;

- Class C misdemeanor: maximum $500 fine.

WHAT ARE THE PENALTIES FOR INSURANCE FRAUD IN TEXAS?

A person charged with insurance fraud may be eligible for probation after a conviction, or deferred adjudication without a conviction. The period of community supervision for a Class A or Class B misdemeanor may not exceed two years. A person may be placed on deferred adjudication for a Class C misdemeanor for up to 180 days.

Community supervision for insurance fraud charged as a state jail felony may range from two to five years, with the possibility of extending supervision for up to ten years.

A person charged with third degree felony insurance fraud may be placed on probation for a term between two and five years, or deferred adjudication for up to ten years. If charged with a second degree felony or first degree felony, the period of community supervision may not exceed ten years.

WHAT ARE THE DEFENSES TO INSURANCE FRAUD IN TEXAS?

The statute does not authorize specific defenses to insurance fraud. A person accused thereof may attempt to negate at least one of the elements the State must prove at trial.

WHAT IS THE STATUTE OF LIMITATIONS FOR INSURANCE FRAUD IN TEXAS?

The limitation period for insurance fraud categorized as a misdemeanor is two years. If insurance fraud is classified as a felony, the limitation period is five years.

INSURANCE FRAUD IN TEXAS

A person commits insurance fraud by preparing or presenting a materially false or misleading statement to an insurer in support of a claim for payment, or an application for an insurance policy. A person also commits insurance fraud by soliciting or receiving a benefit in connection with a good or service for which a claim has been submitted under an insurance policy.

TEXAS INSURANCE FRAUD COURT CASES

The case law regarding insurance fraud in Texas illustrates the statute’s application.

- In Awad v. State, the defendant owned a tow truck company, and insured most of his trucks through Progressive. One of his uninsured trucks was damaged, so he had an employee take it to his RV park, and the defendant added it to his insurance policy. A week later, he told Progressive the truck had been in a wreck, and Progressive paid out over $30,000 after declaring the truck a total loss. The employee who towed the truck told Progressive the truth four months later, and the defendant was convicted of insurance fraud. His conviction was affirmed.