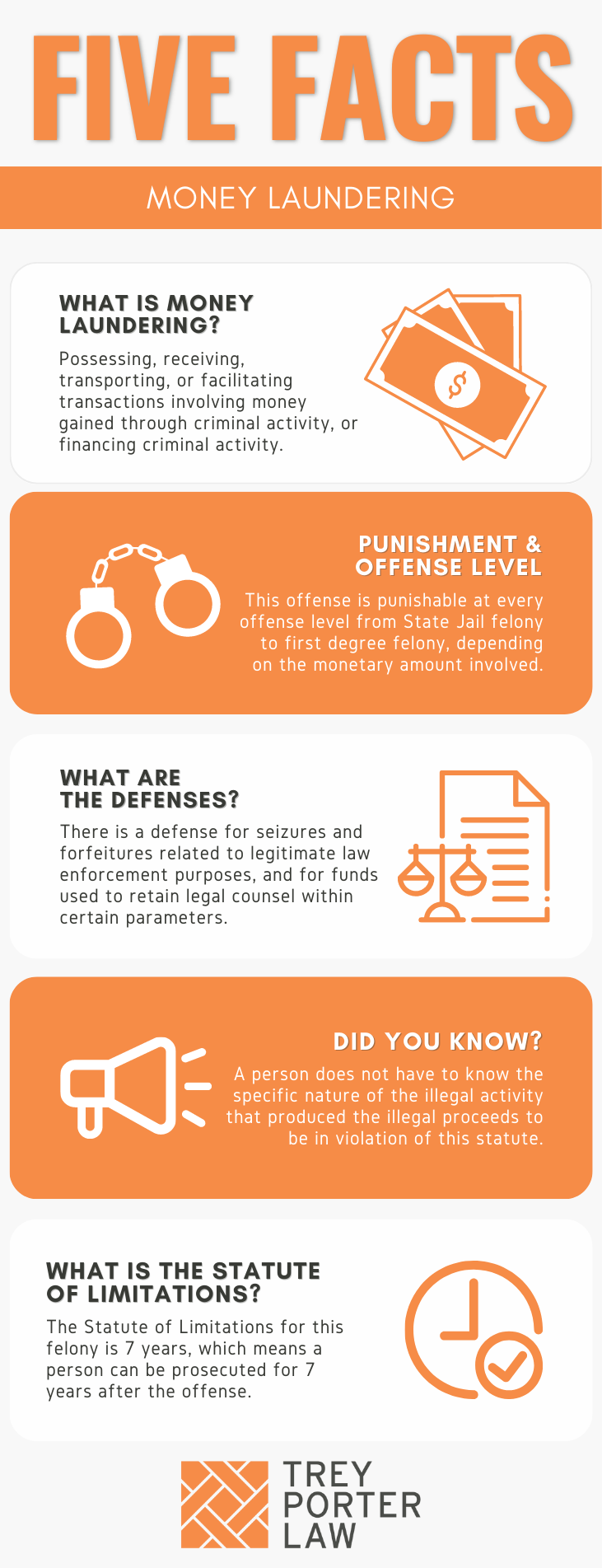

WHAT IS MONEY LAUNDERING IN TEXAS?

The Texas law against money laundering prohibits possessing, receiving, transporting, concealing, investing, or facilitating a transaction involving money gained through the commission of a crime, or financing criminal activity.

WHAT IS THE MONEY LAUNDERING LAW IN TEXAS?

Tex. Penal Code § 34.02. MONEY LAUNDERING.

(a) A person commits an offense if the person knowingly:

(1) acquires or maintains an interest in, conceals, possesses, transfers, or transports the proceeds of criminal activity;

(2) conducts, supervises, or facilitates a transaction involving the proceeds of criminal activity;

(3) invests, expends, or receives, or offers to invest, expend, or receive, the proceeds of criminal activity or funds that the person believes are the proceeds of criminal activity; or

(4) finances or invests or intends to finance or invest funds that the person believes are intended to further the commission of criminal activity.

(a-1) Knowledge of the specific nature of the criminal activity giving rise to the proceeds is not required to establish a culpable mental state under this section.

(b) For purposes of this section, a person is presumed to believe that funds are the proceeds of or are intended to further the commission of criminal activity if a peace officer or a person acting at the direction of a peace officer represents to the person that the funds are proceeds of or are intended to further the commission of criminal activity, as applicable, regardless of whether the peace officer or person acting at the peace officer’s direction discloses the person’s status as a peace officer or that the person is acting at the direction of a peace officer.

(c) It is a defense to prosecution under this section that the person acted with intent to facilitate the lawful seizure, forfeiture, or disposition of funds or other legitimate law enforcement purpose pursuant to the laws of this state or the United States.

(d) It is a defense to prosecution under this section that the transaction was necessary to preserve a person’s right to representation as guaranteed by the Sixth Amendment of the United States Constitution and by Article 1, Section 10, of the Texas Constitution or that the funds were received as bona fide legal fees by a licensed attorney and at the time of their receipt, the attorney did not have actual knowledge that the funds were derived from criminal activity.

(e) An offense under this section is:

(1) a state jail felony if the value of the funds is $2,500 or more but less than $30,000;

(2) a felony of the third degree if the value of the funds is $30,000 or more but less than $150,000;

(3) a felony of the second degree if the value of the funds is $150,000 or more but less than $300,000; or

(4) a felony of the first degree if the value of the funds is $300,000 or more.

(f) For purposes of this section, if proceeds of criminal activity are related to one scheme or continuing course of conduct, whether from the same or several sources, the conduct may be considered as one offense and the value of the proceeds aggregated in determining the classification of the offense.

(g) For purposes of this section, funds on deposit at a branch of a financial institution are considered the property of that branch and any other branch of the financial institution.

(h) If conduct that constitutes an offense under this section also constitutes an offense under any other law, the actor may be prosecuted under this section, the other law, or both.

WHAT IS THE PENALTY CLASS FOR MONEY LAUNDERING IN TEXAS?

The penalty classification for money laundering depends on the amount of funds or proceeds involved. Money laundering is a:

- State jail felony, punishable by 180 days to two years in a state jail facility, if:

- the value of the funds is $2,500 or more but less than $30,000;

- Third degree felony, punishable by two to ten years in prison, if:

- the value of the funds is $30,000 or more but less than $150,000;

- Second degree felony, punishable by two to 20 years in prison, if:

- the value of the funds is $150,000 or more but less than $300,000;

- First degree felony, punishable by five to 99 years or life in prison, if:

- the value of the funds is $300,000 or more.

WHAT IS THE PUNISHMENT RANGE FOR MONEY LAUNDERING IN TEXAS?

The punishment range for money laundering corresponds to the value of the funds or proceeds derived from criminal activity, or offered to finance criminal activity.

- First degree felony (value of $300,000 or more):

- five to 99 years or life in prison, maximum $10,000 fine;

- Second degree felony (value of $150,000 or more but less than $300,000):

- two to 20 years in prison, maximum $10,000 fine;

- Third degree felony (value of $30,000 or more but less than $150,000):

- two to ten years in prison, maximum $10,000 fine;

- State jail felony (value of $2,500 or more but less than $30,000):

- 180 days to two years in a state jail facility, maximum $10,000 fine.

WHAT ARE THE PENALTIES FOR MONEY LAUNDERING IN TEXAS?

A person charged with money laundering may be eligible for probation after a conviction, or deferred adjudication without a conviction. The period of community supervision for a state jail felony may range from two to five years, with the possibility of extending supervision for up to ten years.

A person charged with money laundering classified as a third degree felony may be placed on deferred adjudication for up to ten years, or probation for a period between two and five years. The community supervision term for a first degree or second degree felony may not exceed ten years.

WHAT ARE THE DEFENSES TO MONEY LAUNDERING IN TEXAS?

The statute authorizes specific defenses to money laundering. A person may assert the alleged money laundering was lawful if the person:

- acted with intent to facilitate a lawful seizure, forfeiture, or disposition of funds, or other legitimate law enforcement purpose;

- used the funds to hire an attorney to defend him or her in a criminal case; or

- was a licensed attorney who accepted the funds as bona fide legal fees, and did not know the funds were derived from illegal activity.

WHAT IS THE STATUTE OF LIMITATIONS FOR MONEY LAUNDERING IN TEXAS?

The limitation period for money laundering is seven years.

MONEY LAUNDERING IN TEXAS

Money laundering in Texas is possessing, transporting, investing, offering to invest, or receiving proceeds of criminal activity. A person also commits money laundering by facilitating a transaction involving the proceeds of criminal activity, or using funds with the intent to finance further commission of criminal activity.

TEXAS MONEY LAUNDERING COURT CASES

The case law regarding money laundering in Texas explains the proof required to sustain a conviction.

- In DeLay v. State, Tom DeLay was convicted of money laundering while serving as the Republican Majority Whip of the U.S. House of Representatives. He was on the board of a political-action committee (“TRMPAC”), which accepted $190,000 from a corporation in violation of the Texas Election Code, and transferred $190,000 back to the corporation out of a different account.DeLay was convicted of money laundering, but the Texas Court of Criminal Appeals reversed. The Court held the evidence was insufficient to prove DeLay and the contributing corporation knew the money exchange violated the Election Code, and were proceeds of criminal activity.

- In Acosta v. State, the defendant, a truck driver, was convicted of money laundering after a State trooper found $502,020 hidden behind the truck speakers. He argued on appeal the evidence was insufficient to show knowingly transported proceeds of criminal activity.The appellate court affirmed. The evidence supported the nexus between the money and criminal activity: (1) the large amount of cash; (2) the money was vacuum-sealed in bundles; (3) the drug K-9 alerted to it, indicating it had been around narcotics; (4) the defendant denied knowledge of it; and (5) the defendant was returning to El Paso, known as the domestic starting point for drug loads.